Euro and US dollar:

- S&P cut Italian outlook to negative, rating untouched.

- Chancellor Merkel suffers losses in Hesse elections.

We have just released our Brand New Q4 Trading Forecasts including USD and EUR.

EURUSD Rattled by Political Risk

EURUSDcontinues to cling to a1.1400 handle - but only just - as Italy and the EU remain at loggerheads over Italy’s contentious budget. The EU has said that Italy must make changes to its budget to comply with EU rules and present the new version by November 13. Italy is also in the headlines after ratings agency S&P cut its outlook on the country to negative but left its rating unchanged. Italian bonds picked up a little on the news, but yields stay elevated and the German/Italy 10-yr spread remains over 300bps.

In Germany, Chancellor Angela Merkel’s coalition party suffered heavy losses in regional elections in the state of Hesse, just weeks after Merkel conservative allies were heavily beaten in Bavaria. Merkel will stand for re-election as party leader of the CDU in December and the latest voting may see her position come under increasing pressure.

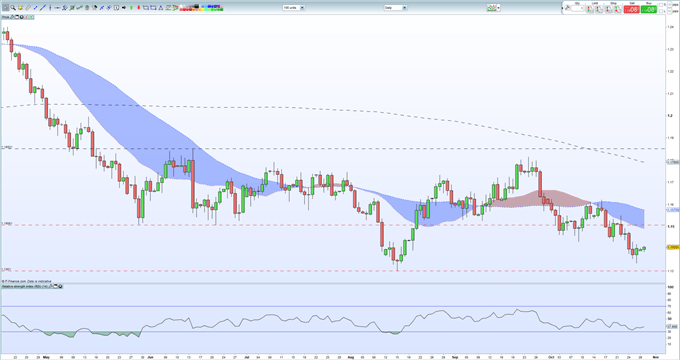

EURUSD remains weak and is set to test the downside again. Last week’s low at 1.13358 remains in sight ahead of the recent 16-month low at 1.1300. The upside remains capped by 50% Fibonacci retracement at 1.14580. A raft of Euro-Zone hard data releases on Tuesday may well be the trigger for the next leg lower.

IG Client Sentiment Data show investors are currently 63.5% net-long EURUSD – a contrarian bearish signal – but recent daily and weekly positional shifts give us a stronger bearish EURUSD bias.

EURUSD Daily Price Chart (April 2017 – October 29, 2018)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.