EUR Analysis and Talking Points

- Italian Politics Continues to Weigh on Sentiment

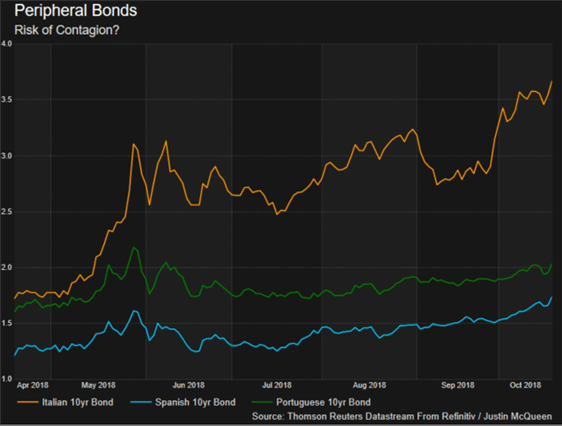

- Contagion Risk on the Rise

Check out the brand new Q4 FX forecast guides

Italian Politics Continues to Weigh on Sentiment

The Euro remains under pressure and is heading towards the 1.14 handle amid the concerns over the Italian budget, setting the EU and Italy on a collision course. Yesterday saw reports that the EU commission had warned that Italy’s budget is a serious and particularly non-compliant proposal with EU rules, which in turn increases the risk that EU could reject the Italian budget unless it is amended. In reaction to the negative sentiment surrounding the Italian budget, Italian bond yields have been surging with the 10yr rising some 9bps today. This in turn has taken the spread against the bund to the widest level in over 5yrs at 330bps and moving ever so closer to the 350-400bps fear zone.

Italian politics remains the dominant driver of the single currency and will seemingly continue to do so in the upcoming week with Italy given until Monday to reply to the EU, while eyes will also be on the rating agencies as they evaluate Italy’s budget (S&P and Moody’s to report next week). A downgrade by the rating agencies could see renewed pressure on Italian and thus weighing on Italian assets further (Italian banks).

Contagion Risk

The move lower in the Euro has been exacerbated by the recent rise in peripheral bond yields (most notably, Spain and Portugal), which in turn have raised concerns over contagion risks with both Spanish and Portuguese bond yields trading at the highest level against the German bund since May.

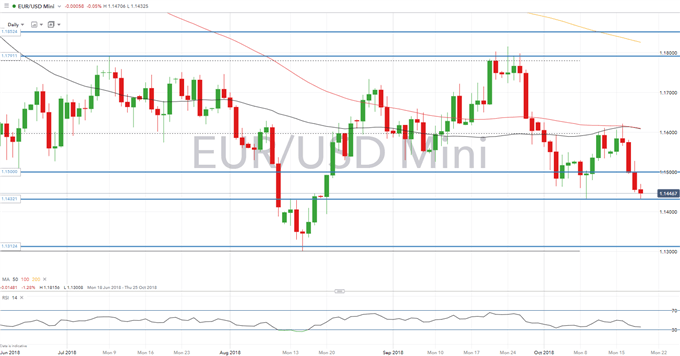

EURUSD PRICE CHART: Daily Time-Frame (June-Oct 2018)

Euro continues to test for lower levels with near term support situated at 1.1430 (last week’s low), while a hefty EUR 2.9bln option expiry at 1.1400-20 could magnetise price action to test the 1.1400 handle on the downside. A close below could indeed push the Euro back towards the 2018 lows of 1.1310.

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q4 forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX