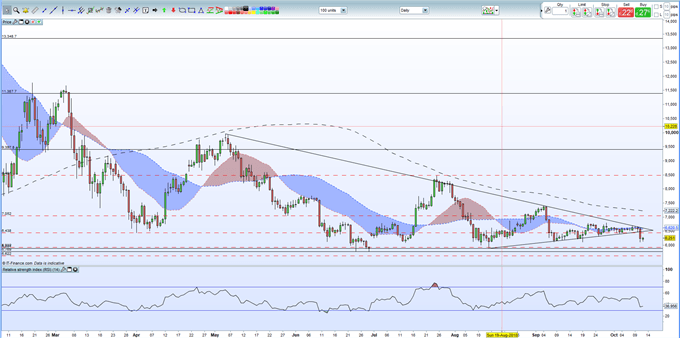

Bitcoin (BTC) Price Analysis

- A tepid dead-cat bounce at best.

- Negative signals all over the chart.

Bitcoin Price Action - Lower for Longer Confirmation

After Thursday’s heavy sell-off across the cryptocurrency market, market leader Bitcoin continues to struggle to make any headway against a negative technical set-up with lower prices likely. The tight trading range breakout has seen BTC break below the decending triangle with little pick-up in trading volume. Bitcoin also trades below all three moving averages with horizontal support now seen between the June 24 low at $5,769 and the August 14 low at $5,887. A break and close below these levels turns the outlook very negative and coud see BTC decline back to the September 2017 low just under $3,000.

DailyFX analyst Paul Robinson wrote last week that Bitcoin “still has significant downside risk” and that it could decline another 85%.

Bitcoin (BTC) Daily Price Chart – October 12

The losses seen in the crypto-space have not been helped by stories (unconfirmed) that crypto-exchange Bitfinex have suspended US dollar deposits with the situation expected ‘to normalize within a week’. Bitfinex trading volume has slumped by over 36% in the last 24 hours, acccording to Coinmarketcap data.

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on Bitcoin and can the market rally further? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.