MARKET DEVELOPMENT – GBP RISES AS EU WELCOMES IRISH BORDER PROPOSAL

GBP: The Pound is outperforming this morning amid EU source reports suggesting that the new Irish border proposal is a step in the right direction, adding that a compromise is possible. As such, GBP has reclaimed the 1.30 handle vs. the USD, while also hitting a 2 ½ month high against the Euro, however, support is situated at the 200DMA (0.8839).

JPY: The Japanese Yen saw a reprieve from the persistent selling that it has endured in recent weeks with USDJPY back towards the 114 handle. This followed reports that the BoJ were said to be not concerned with the recent rise in JGB yields, which in turn suggests that intervention risk from the BoJ may be relatively low. However, with the 10yr JGB yield approaching the 0.2% threshold (currently yielding 0.16%) the risk of intervention may be back on the rise once this level is breached.

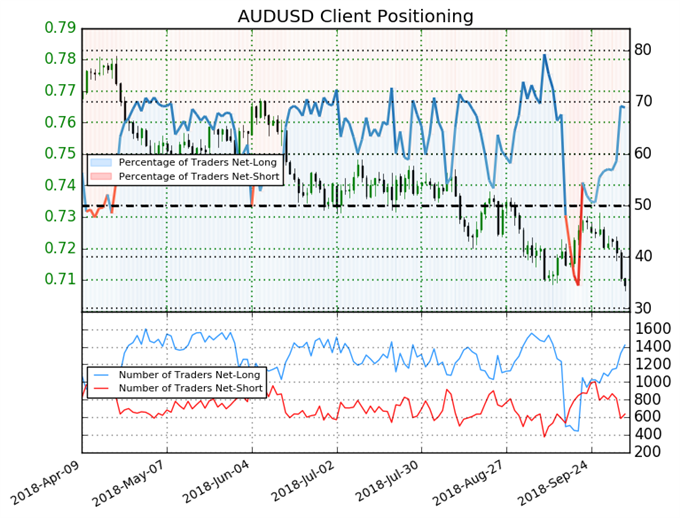

AUD: The Australian Dollar has largely been held captive from its Chinese proxy status, which has seen the currency drop 9% against the greenback. Eyes will be on the 2018 low (0.7066) as US Vice President Pence addresses the issues surrounding China, which could potentially escalate the current tensions between the US and China. With no trade deal in sight, headline risk continues to remain elevated, leaving the Australian Dollar vulnerable to further losses.

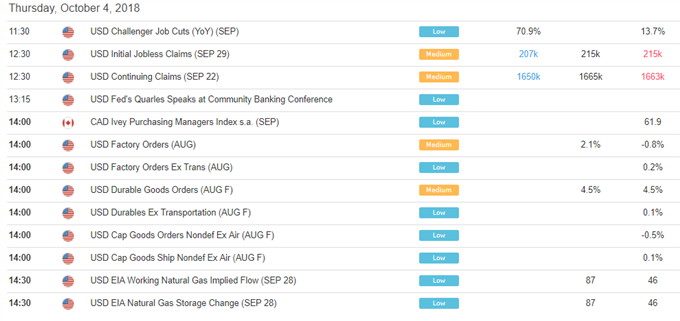

DailyFX Economic Calendar: Thursday, October 4, 2018 – North American Releases

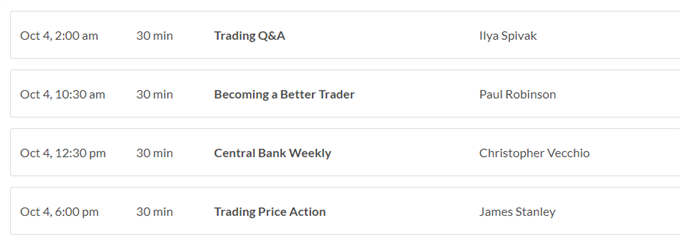

DailyFX Webinar Calendar:Thursday, October 4, 2018

IG Client Sentiment: EURUSD Chart of the Day

AUDUSD: Retail trader data shows 69.0% of traders are net-long with the ratio of traders long to short at 2.22 to 1. In fact, traders have remained net-long since Sep 24 when AUDUSD traded near 0.72483; price has moved 2.3% lower since then. The number of traders net-long is 14.8% higher than yesterday and 31.1% higher from last week, while the number of traders net-short is 23.8% lower than yesterday and 23.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias.

Five Things Traders are Reading

- “US Dollar Strength Unleashed as EUR/USD Tests the 1.1500 Big Figure” byJames Stanley , Currency Strategist

- “AUD Targets 9-yr Low Amid Rising US Yields and Trade War Tensions”by Justin McQueen, Market Analyst

- “US Crude Oil Price Marches Higher Despite Report of Output Increase”by Martin Essex, MSTA , Analyst and Editor

- “Gold Price Continues to Struggle Against Resistance” by Nick Cawley, Market Analyst

- “EURUSD Sliding Towards Technical Support - Will it Hold?” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX