MARKET DEVELOPMENT – ITALIAN ASSETS SINK ON BUDGET ANNOUNCEMENT

EUR: After the largest intra-day drop in 2018, the Euro has extended on losses, breaking below 1.16 against the greenback and subsequently eyeing support at 1.15. However, initial support is seen at 1.1580 for now. The driver of the move has been the uncertainty surrounding Italian politics yet again following the governing coalitions decision to set a deficit to GDP target of 2.4% above the 1.6-1.9% threshold preferred by the Finance Minister Tria (Problems could mount if Tria leaves). In response to the budget announced, Italian bond yields are now at fresh highs with the 10yr rising over 30bps and wider by 38bps against the German 10yr, consequently weighing on the Euro. That said, Italian assets have plunged with the FTSE MIB losing as much as 900points with Italian banks hitting limit down.

GBP: The Pound is softer this morning, following a relatively weak growth report in which the yearly growth figure missed expectations. Elsewhere, business investment showed a surprise drop as investors remain concerned over the outcome regarding Brexit. GBPUSD hover around 1.3040 with the next key support at 1.30. Eyes will be on the Conservative party conference over the weekend, however, judging by historical performance the Pound may extend on losses early next week (Prior Tory party conferences saw a 1% decline in GBP).

CAD: The outperformer in the G10 space is the Loonie following a better than expected GDP reading, which took the spot rate back below 1.30. However, while data and rate expectations continue to keep the CAD afloat, the major concerns are centred around NAFTA and with no signs of any real progress, the pressure will likely mount for the currency.

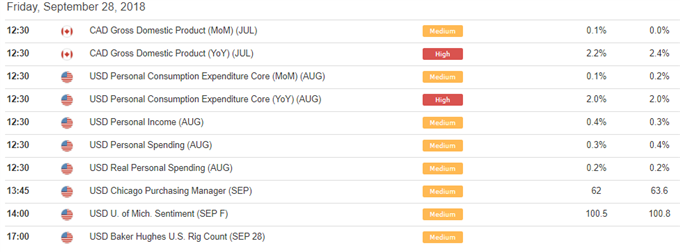

DailyFX Economic Calendar: Thursday, September 27, 2018 – North American Releases

DailyFX Webinar Calendar: Thursday, September 27, 2018

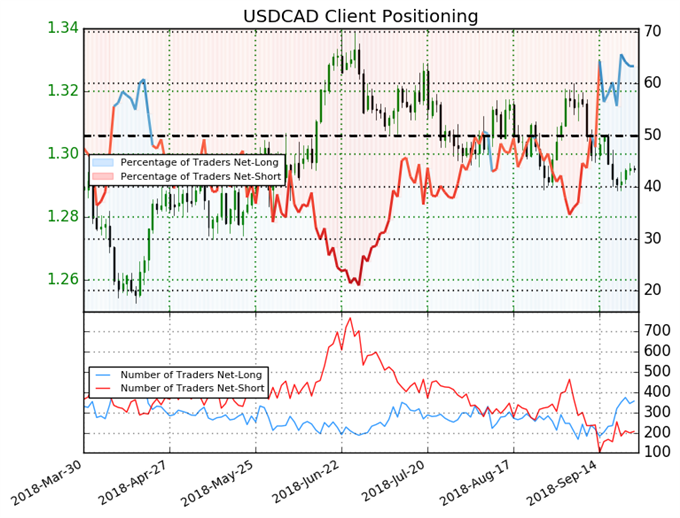

IG Client Sentiment: USDCAD Chart of the Day

USDCAD: Retail trader data shows 63.3% of traders are net-long with the ratio of traders long to short at 1.73 to 1. In fact, traders have remained net-long since Sep 14 when USDCAD traded near 1.30311; price has moved 0.6% lower since then. The number of traders net-long is 8.5% lower than yesterday and 58.2% higher from last week, while the number of traders net-short is 8.4% higher than yesterday and 10.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias.

Five Things Traders are Reading

- “USDJPY Bulls In Control, Widening Bond Spreads Support Upside” by Justin McQueen, Market Analyst

- “Charts for Next Week – EUR/USD, GBP/USD, Gold Price & More" by Paul Robinson, Market Analyst

- “EURUSD Battles Negative Italian Budget Sentiment, Weak CPI”by Nick Cawley, Market Analyst

- “Gold Price Range Finally Breaks, Silver Bear-flag Set to Trigger” by Paul Robinson, Market Analyst

- “Bitcoin (BTC) Price: Bullish Chart Pattern Forming” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX