Oil Price Analysis and News

- Hedge Funds Bullish Brent Again as Sanctions Loom

- Oil Backwardation Highest Since May

Hedge Funds Bullish Brent Again as Sanctions Loom

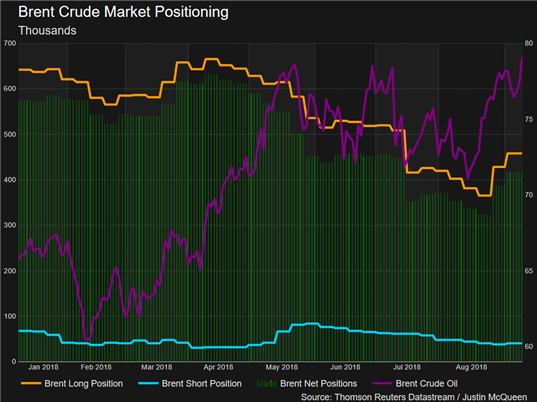

After months of liquidating long positions, hedge funds are now bullish again on Brent crude with long positions increasing after the past two weeks, according to CFTC data. This comes amid the Iranian oil sanctions which are set to be imposed on November 4th, while the US have also demanded nations to drop Iranian imports to zero. Ahead of the sanctions, South Korea has become the first of Iran’s top three oil importers to drop imports to zero after halting purchases in August from 194k barrels in July. Eyes will be on Iranian oil import data from China and India who typically import around 500-700k barrels.

Oil Backwardation Highest Since May

As investors grow concerned that Iranian sanctions may leave the market short of crude oil, November Brent crude futures now trade at a premium of $0.47 over the December contract, highest since May. As a result of the increasing premium, the positive monthly roll could see speculators increase their bullish bets and potentially taking the spot price back above $80.

Brent Crude November-December Spread

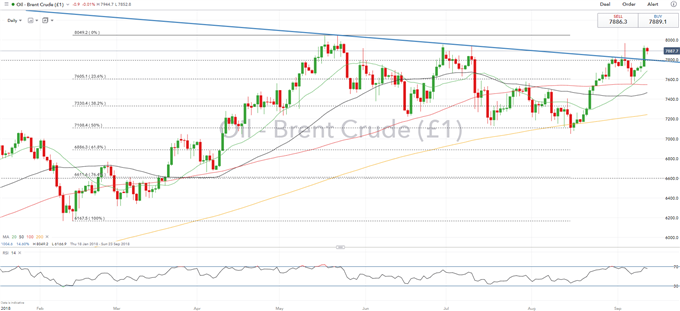

Oil Price Chart: Daily Time Frame (January-September 2018)

Brent crude futures have made a firm breach of the descending trendline which has curbed price action previous. Yesterday’s close above the key resistance line paves the way for a test of the $80 barrel mark, before a retest of the YTD high. However, trend signals have weakened with the RSI indicators showing a slight pullback.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX