Asia Pacific Market Open – Apple, Crude Oil, S&P 500, Brexit, USD/JPY, US Dollar

- Japanese Yen prices depreciate across the board as Apple, Oil prices boost S&P 500

- NAFTA progress further lifts the Canadian Dollar, GBP down as May could be ousted

- The US Dollar remains in a consolidation mode as the June uptrend and support holds

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

For most of Tuesday’s session, market mood continued to improve as expected which weakened the anti-risk Japanese Yen across the board. It began during the Asia Pacific trading session where the Nikkei 225 had its best daily performance since August 14th. But then, sentiment briefly deteriorated during European market hours.

This seemed to have occurred for two main reasons. First, the US Dollar rose alongside government bond yields which showed that Fed rate hike bets increased. Second, a report crossed the wires that China is planning on asking the WTO to authorize trade sanctions against the US. This is amidst plans from the Trump administration to step up tariffs against China on $200b worth of goods and potentially more.

Then market mood considerably improved during the US trading session as the S&P 500 rallied about 0.37%. The index was supported by energies and tech. The former was accompanied with rising crude oil prices as Hurricane Florence approached the US east coast, threatening supplies. As for the latter, Apple shares soared ahead of the launch of new iPhone products.

Elsewhere, the Canadian Dollar was arguably the best performing FX major as it gained with crude oil prices. But it extended gains on reports that Canada is ready to give the US concessions on dairy in NAFTA talks. Mr. Trump also added that a trade deal with them is coming along “very well”. The sentiment-linked Australian and New Zealand Dollars were little changed by the end of the day and so too was the US Dollar.

As we head into Wednesday’s APAC trade, the British Pound is cautiously lower after Tory Brexiters were said to plot to oust Prime Minister Theresa May. Her “Chequers” proposal for Brexit was recently opposed by 80 rebels in her party. As for equities, the Nikkei 225 could echo the strong performance on Wall Street which would further weigh against the Yen which could take USD/JPY out of consolidation.

US Dollar Technical Analysis – June Trend Line Holds

The US Dollar remains in consolidation mode after a shooting star bearish reversal pattern preceded a 2.6% drop in DXY from the August 15th high. The greenback at one point fell under the rising support line from June, but it was a false breakout. At the moment, this trend line is keeping the US Dollar from taking additional loses.

A descent through the trend line exposes the lows set in late August around 94.43 and a push under could lead to a reversal of its dominant uptrend. On the other hand, immediate resistance is a range between 95.53 and 95.71. A climb above that area then opens the door to retest the August 15th high.

DXY Daily Chart

Chart created in TradingView

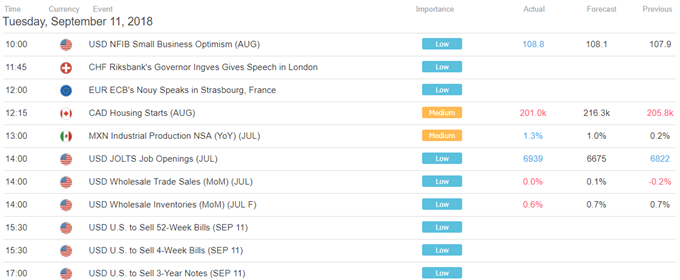

US Trading Session

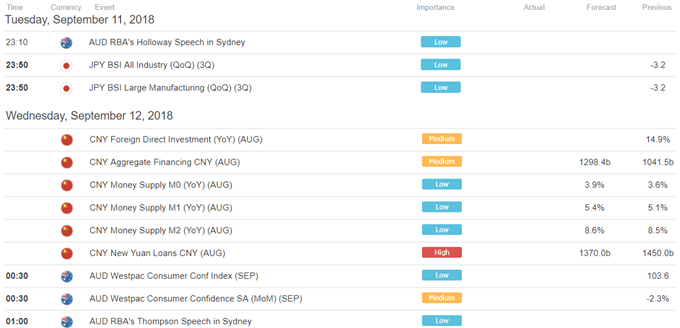

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See our free guide to learn what are the long-term forces driving US Dollar prices

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Yen is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter