Cryptocurrency Prices, News and Technical Analysis

- Positive market sentiment washed away as sellers run riot.

- Support levels look vulnerable on the charts.

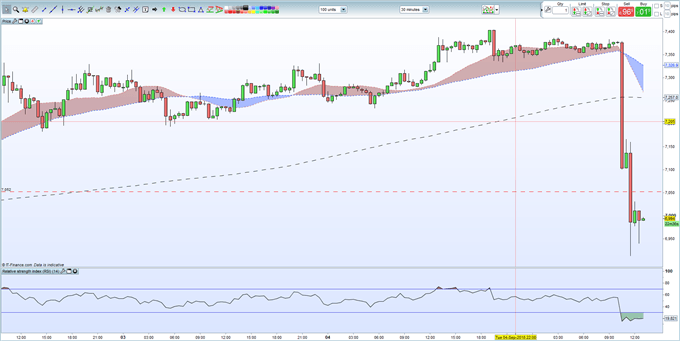

Cryptocurrency Prices Crash in One-Hour Timeframe

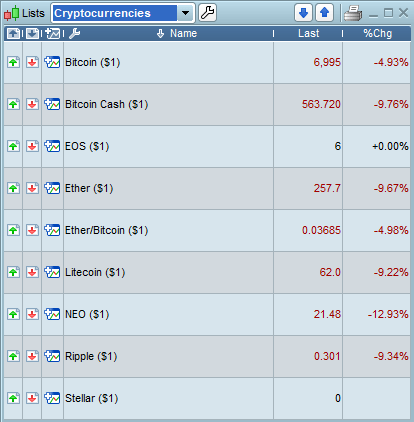

A heavy sell-off saw bids disappear and sent markets sharply lower in mid-morning trade with little on the wires to explain the crash. Tokens that had been gradually nudging higher over the past two-to three-weeks saw their gains wiped out in a one-hour timeframe as trading sentiment turned sharply bearish in the short-term. Theories behind the sell-off include an exchange liquidating a position/s, trading difficulties at one exchange (unsubstaniated) and a story circulating that US investment powerhouse Goldman Sachs had ditched plans to open a cryptocurrency trading desk for now.

Market leader Bitcoin (BTC) was the least affected in the sell-off, but still dropped nearly 5% and now hovers either side of $7,000, down $400 in the session.

Bitcoin (BTC) 30-Minute Price Chart (November 2017 – September 5, 2018)

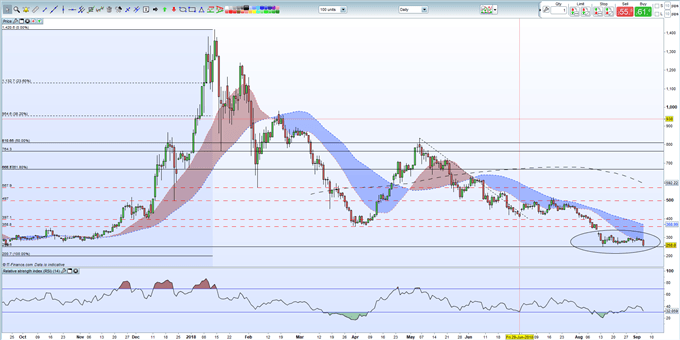

Ethereum (ETH) came close to touching a near one-year low during the crash and needs support at $258 to hold or $200 comes into view.

Ethereum Daily Price Chart (September 2017 – September 5, 2018)

We look at Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the latest market crash? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.