Oil Price Analysis and News

- Uptrend Fragile Following Rejection of Crucial Resistance

- Global Oil Supply on the Rise

For a more in-depth analysis on Oil Prices, check out the Q3 Forecast for Oil

Uptrend Fragile Following Rejection of Crucial Resistance

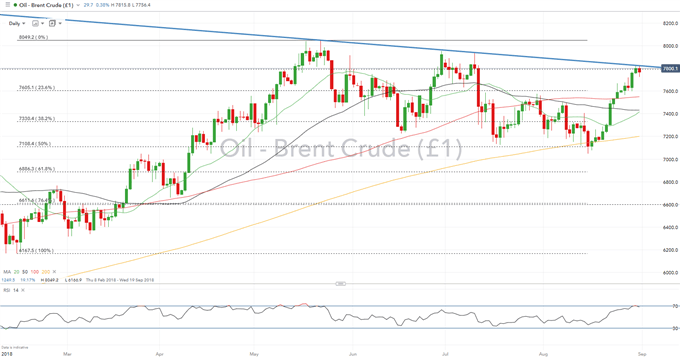

As mentioned last week, the signals for Brent crude futures had indeed been bullish with the price rising from $76 to highs of $78.30. However, the uptrend is looking somewhat fragile with key resistance hovering slightly above current levels. The descending trendline from the peaks seen in May and July has held steady for now with two attempts to break above failing. Alongside this, the 50% Fibonacci retracement ($128.40-27.43 fall) situated at $77.91 also acts as firm resistance. Eyes will be on for a daily close above this level to confirm that the uptrend is still intact.

OIL PRICE CHART: Daily Time-Frame (January-September 2018)

Global Oil Supply on the Rise

According to a Reuters survey, OPEC oil production has risen to a 2018 high of 32.79mbpd, up 220kbpd. This was largely due to the recovery in Libyan oil production, while Iraq’s oil exports in the south had risen to a record high. Elsewhere, US oil production is back on the rise with the latest Baker Hughes Rig Count showing that US drillers added oil rigs for the first time in 3 weeks.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX