EURUSD – Price, Chart and Technical Analysis

- US-EU trade wars are back in the spotlight.

- Turkish Lira volatility may pose problems for European banks.

- Rating’s agency Fitch reports on Italy’s creditworthiness.

The latest IG Client Sentiment Indicator shows how retail are currently positioned in EURUSD - 61% short – giving us a bullish contrarian outlook.

The DailyFX Q3 forecasts and analysis of USD and EUR are just two of the major currencies available to download here.

EURUSD Facing Headwinds

As we close the week, EURUSD is under the spotlight as a raft of political events appear in view. And the single-block currency is likely to slip lower as negative sentiment builds.

First up, US EU trade wars are once again back in the headlines as President Trump continues with his bombastic campaign. Yesterday reports revealed that the EU may well cancel all tariffs on US industrial products, including cars, to scale back trade tensions between the two economies. However, US President Trump, who originally called for this stance, has now said that his offer is ‘not good enough’ adding that European consumer habits ‘are to buy their cars, not to buy our cars’. This latest intervention by POTUS leaves the very real possibility of further, drawn out trade wars between the EU and US.

Turkish Lira volatility continues with USDTRY swinging sharply in a wide range. European bank chiefs will continue to monitor this situation closely with some more exposed to Turkish risk than others. If the USDTRY continues to push back towards its recent high, these concerns will heighten, weighing on the euro.

USDTRY Daily Price Chart (February – August 31, 2018)

Later in the session, rating’s agency Fitch will publish its latest Italian creditworthiness report with a sovereign downgrade seen as unlikely but not fully off the table. Any credit downgrade would increase Italian borrowing costs at a time when the country is finalising its new spending plans.

DailyFX analyst Dimitri Zabelin has produced a timely and concise report on How the Euro will be Affected by the Rise of Italian Economic Nationalism.

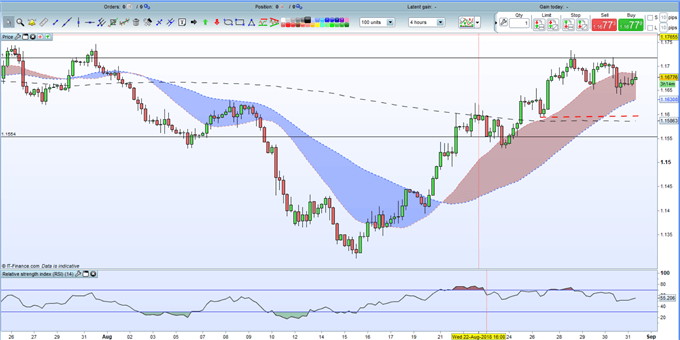

EURUSD – The Downside Prevails

The path of least resistance for the euro continues to point lower with Monday’s low at 1.15944 and the 200-day moving average at 1.15861 the first levels of support. The upside is expected to be capped by Tuesday’s high print of 1.17336.

EURUSD Four Hour Price Chart (July – August 31, 2018)

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on EURUSD, the Turkish Lira and Italy? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

--- Written by Nick Cawley, Analyst