Talking Points:

- Brazilian QoQ GDP was 0.2% versus an expected 0.1%, year-over-year GDP was 1.0%

- India saw robust growth, posting 8.2% in the most recent quarter

- The data releases provide some buoyancy for troubled emerging market currencies amid crisis concerns

Want to know what makes some traders more successful than others? Browse our Beginner Guides to see the Number One Mistake Traders Make.

After consecutive days of weakness for emerging markets, the world’s fifth and seventh largest economies by GDP looked to stall a broader decline with positive GDP data. Due to their size, the two countries carry significant weight in the emerging market basket and their growth will surely generate some positive sentiment to counteract the issues facing the basket as a whole.

Brazil GDP Delivers near Target

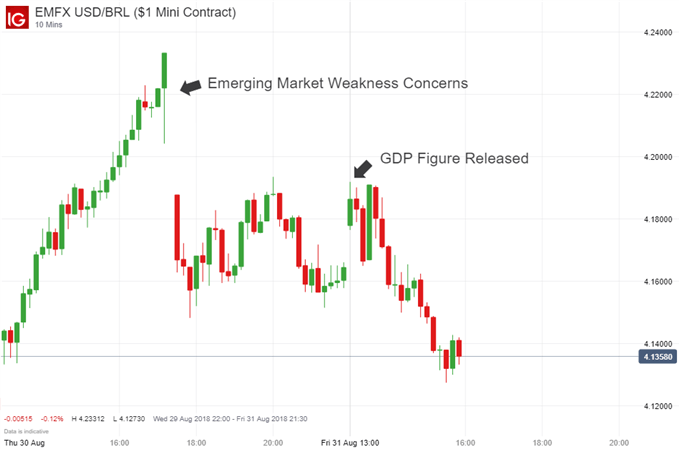

As for the specifics, Brazil’s Q2 quarter-over-quarter GDP read in at 0.2%. A rather low figure for global standards. According to the World Bank, global GDP was 3.1% in 2017. Still, Brazils 0.2% GDP growth surpassed the expected 0.1%. Year-over-year GDP came in below the expected 1.1% at 1.0%. South America’s largest nation has been beleaguered by a trucker strike and political concerns as a presidential election looms. Coupled with domestic concerns, regional developments like Venezuela’s hyperinflation also worked to weigh down the Brazilian economy. Following the data release, the Brazilian real saw a reprieve from recent troubles and gained ground versus the dollar.

USD/BRL Price Chart 10-Minute Time Frame, August 30th – 31st

The real was up 0.73% versus the greenback, trading near 4.135 at the time of this article. The news is a welcome development that may help to temper losses by the real should emerging market concerns continue.

Indian GDP Surpasses All Expectations

Shattering global standards, Indian GDP read in at a staggering 8.2%. The figure marks the highest growth in two years, the strongest since the first quarter of 2016. The data also surpassed domestic expectations of 7.5% growth.

USD/INR Price Chart 10-Minute Time Frame, August 30th – 31st

Again, the strong figure generated a brief rally in the rupee versus the dollar. Moving forward, market participants will take note of the strong GDP figure but it may not be enough to completely stop the rupee’s decline. Although the rupee traded around 71.085 at the time of this article, Friday morning saw the rupee trade at its lowest level versus the dollar ever near 71.600.

Strong GDP Unlikely to Stop Broader Emerging Market Decline

Although both Brazil and India delivered robust results, the issue emerging markets face is larger than data releases can counteract. Trade wars, sanctions, and other headwinds have battered emerging markets. The steep decline in currencies like the Argentine peso and the Turkish lira have spread weakness and concern to countries that were otherwise on strong footing. Collectively, the recent weakness is enough to drag down even the strongest emerging markets like India.

DailyFX forecasts on a variety of currencies such as the US Dollar or the Yen are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introduction to the Forex market, check out our New to FX Guide.

--Written by Peter Hanks, Junior Analyst for DailyFX.com