GBP Analysis and Talking Points

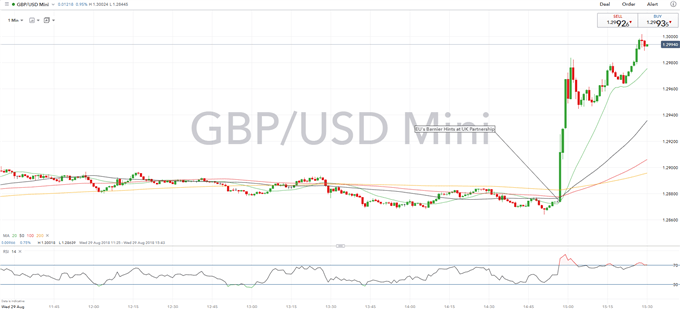

- GBP Surges as Barnier Hints at Post Brexit Partnership

- Psychological 1.30 handle holds for now

See our Q3 GBP forecast to learn what will drive the currency through the quarter.

GBP Surges as Barnier Hints at Post Brexit Partnership

The Pound soared by over 100 pips against the greenback after optimistic comments from EU Chief Negotiator Michel Barnier, who stated that the EU would be prepared to offer a partnership with the UK after Brexit. Consequently, GBPUSD rose from 1.2870 to 1.2980, with scope for a further boost as risks of a no-deal Brexit, subsequently repriced, which in turn has propelled GBP higher, while this also provides a sign that the EU is willing to budge from its recent negotiating position.

However, Barnier did add that single market access is not negotiable, while UK Brexit Minister Raab stated that the UK’s Brexit plan had been greeted with a reasonably positive reaction from other EU members.

GBP/USD PRICE CHART: 1-Minute Time-Frame (Intra-day)

Eyes on the psychological 1.30 handle, which has curbed further upside for now. A break above 1.30 could see 1.3066 come into focus, which marks the 23.6% fib level of the 1.4377-1.2661 fall.

Additional GBP/Brexit Analysis

Brexit Latest: Kicking the Can or Sealing a Plan? by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX