See our 3Q forecasts for the US Dollar and Equities in the DailyFX Trading Guides page

US Session Developments – Emerging Market Stock Indexes Weaker, S&P 500 Declines

US benchmark stock indexes gapped and traded lower Monday, echoing weakness from Friday’s session when the ECB’s concern about European bank exposure to the Lira unnerved investors as USD/TRY rose over 15%. The S&P 500 is now on a 4-day losing streak after failing to reach January highs, this marks its longest consecutive losing spree in about five months.

The pickup in S&P 500 loses coincided with a drop in the MSCI Emerging Markets ETF, perhaps reflecting increased worries about developing countries being susceptible to contagion due to exposure to Turkish assets. Earlier in the day, the Central Bank of Turkey cut Lira and FX reserve ratios in an attempt to boost liquidity. Markets initially rallied, but the decline in sentiment later on might have reflected a fulfillment for more protective and supportive local policy measures that perhaps were not met.

In the FX majors spectrum, the anti-risk Japanese Yen and Swiss Franc outperformed against most of their major counterparts. Meanwhile, the sentiment-linked Australian and New Zealand Dollars fell. Albeit, NZD did not quite suffer as much as AUD. The latter might have received more attention from risk trends given how dovish the RBNZ was last week. That made the RBA relatively more likely to raise rates sooner.

Tuesday Asia/Pacific Trade Preview – Can Chinese Data Improve Sentiment?

Given that the markets, particularly in emerging economies, are still feeling headaches from Turkish developments over the past couple of days, we may see more weakness in benchmark stock indexes ahead. However, declines may not be as pronounced without new updates and Asia/Pacific shares may trade cautiously lower or consolidate.

We will get Chinese retail sales and industrial production statistics for the month in which US tariffs on China imports went into effect. The country is Australia’s largest trading partner, but the data’s implication for AUD/USD could be limited from a monetary policy perspective given that the RBA remains patient before raising rates.

However, if sentiment improves on outperforming Chinese economic data despite the US levies, then the Australian Dollar might have scope for some gains if the Shanghai Composite rallies. In the event that the markets turn jubilant, the anti-risk Japanese Yen could also fall behind.

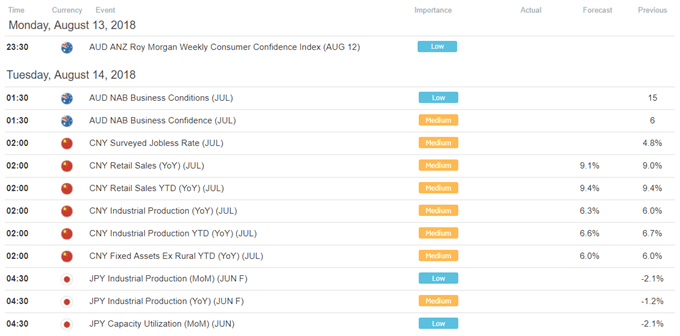

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

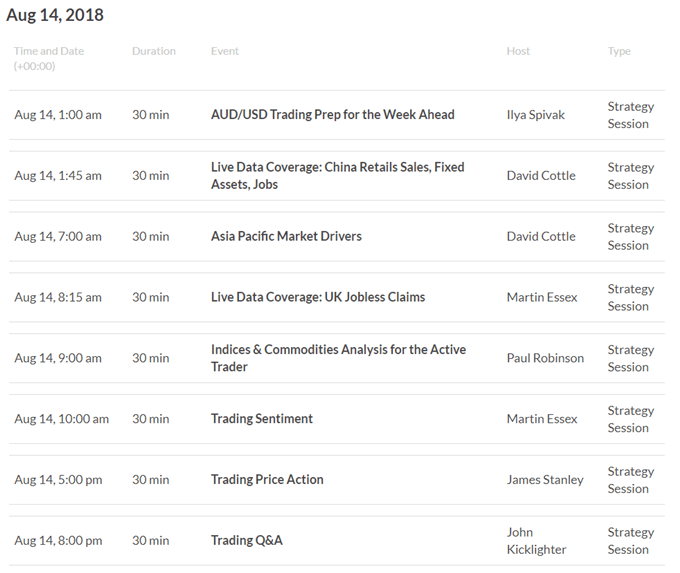

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

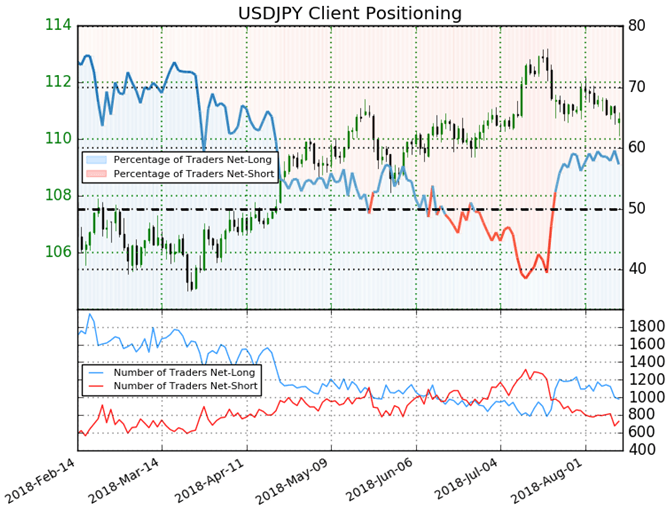

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 57.3% of USD/JPY traders are net-long with the ratio of traders long to short at 1.34 to 1. In fact, traders have remained net-long since Jul 23 when USD/JPY traded near 111.439; price has moved 0.7% lower since then. The number of traders net-long is 7.2% lower than yesterday and 13.9% lower from last week, while the number of traders net-short is 4.1% lower than yesterday and 8.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- Italy’s League Calls for ECB Bond Guarantee, Warns of Euro Collapse by Peter Hanks, Junior Analyst

- FX Week Ahead: Turkey, UK CPI, US Retail Sales, and Aussie Jobs by Christopher Vecchio, CFA, Sr. Currency Strategist

- AUD/USD Forecast: Bearish Behavior to Persist as Summer Range Snaps by David Song, Currency Strategist

- EUR/JPY Price Plummets Through Fibonacci Support by James Stanley, Currency Strategist

- AUD/NZD Nets Out Market Mood Swings, Focus On RBA & RBNZ Policy by Daniel Dubrovsky, Junior Analyst

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter