TALKING POINTS – YEN, GDP, BOJ, CPI, USD, TRADE WARS

- Yen did not significantly react to local GDP data despite exceeding forecast

- Japan and US trade talks underway with focus on reducing auto tariffs

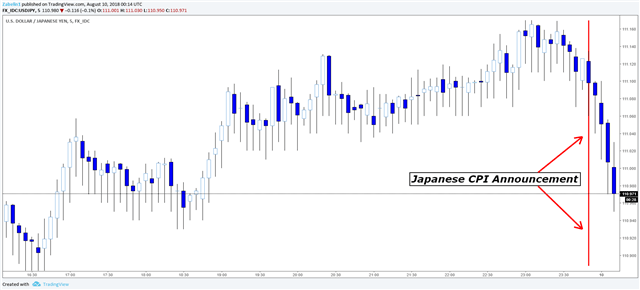

- US CPI data may be key factor in influencing USD/JPY exchange rates

See our free guide to learn how to use economic news in your trading strategy!

The Japanese Yen did not have any momentous price movement against its US counterpart as local GDP data showed a 1.9% annualized growth rate, beating the forecast of 1.4%. The market’s response to the new data indicates that other economic factors may play a more significant role in influencing the Yen’s price movement.

The BOJ may not alter its monetary policy anytime soon with its focus still primarily on achieving a 2% inflation target. The price growth rate (excluding fresh food) stood at just 0.8% that as of July. Interest rate futures markets indicate that the next probable rate hike will occur only in March 2020.

Looking ahead, the markets are now focusing on the upcoming US CPI data that is scheduled to be released on August 10th at 12:30 GMT. The outcome of trade talks between the US and Japan currently underway is also of note. Trade Representative Lighthizer and Japanese Economy Minister Motegi are discussing proposed auto import tariffs and the TPP free trade accord, which the Trump administration has opted to abandon.

USD/JPY TRADING RESOURCES:

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst, DailyFX