Talking Points:

- The official cash rate for New Zealand remains at 1.75%, last changed in November 2016

- Downward pressure on the kiwi is likely to resume following the decision and dovish remarks

- Next week is a quiet week for the NZD, check out our economic calendar for relevant events

Third Quarter Forecasts for Currencies, Commodities and Equities are out! They can provide useful insight to enhance your trading opportunities.

Reserve Bank of New Zealand Leaves Interest Rate Unchanged

The official cash rate of New Zealand remained unchanged at 1.75% after Wednesday’s central bank meeting. Governor Adrian Orr and his central bank have not changed the rate since late 2016 when it was lowered from 2%. The decision comes at a time when the New Zealand economy faces recent soft GDP figures, high real-estate costs, and potential headwinds from the ongoing trade wars waged by the US. Although the US has not directly targeted New Zealand, the island nation is likely to be affected as global supply chains shift.

In past months, Mr. Orr said a rate cut is nearly as likely as a rate hike and heading in to the decision, futures had the probability of a hike in 2018 below 4%. At Wednesday’s central bank meeting, the bank’s dovish stance was confirmed. Governor Orr bolstered their position saying rates will stay expansionary for a considerable period and the forecasted rate increase was pushed back to Q3 2020.

Although the Reserve Bank of New Zealand fortified itsdovish stance, it does have flexibility should conditions change in the future. Unlike neighboring Japan, New Zealand has not dipped in to negative rates. It also has not engaged in significant quantitative easing programs. This affords the central bank monetary policy options that counterparts may not be able to exercise in the near future, however unlikely they may be.

New Zealand Dollar after the Rate Decision

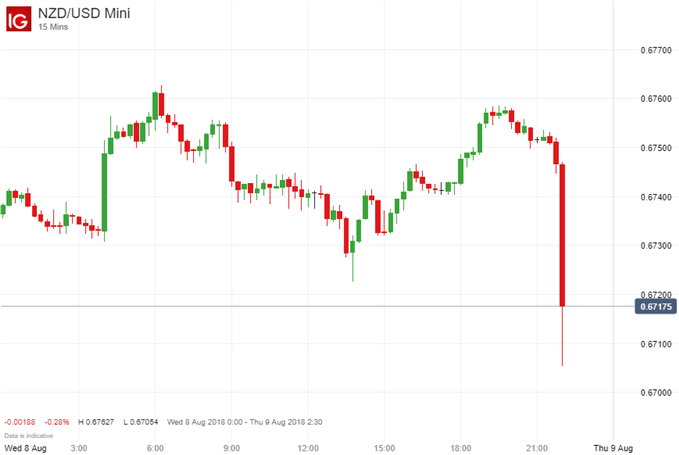

In response to the decision, the NZDUSD pair saw a significant move lower as the US Dollar overshadows the historically high yield status of the kiwi, with interest rates continuing to rise in the United States. In addition, the rate outlook for the RBNZ remains flat. A close relative of the kiwi also moved higher after the rate decision. The Australian dollar pressed higher as the tone between the two neighboring central banks gradually widens.

NZD/USD Price Chart: 15-Minute Time Frame, August 8 (Chart 1)

NZD/AUD Price Chart: 15-Minute Time Frame, August 8 (Chart 2)

New Zealand Dollar Resources:

- NZD Technical Analysis Overview: NZDUSD & NZDJPY Focus Ahead of RBNZ – By Justin McQueen, Analyst

- NZDUSD Technical Analysis: Support Under Fire as RBNZ Nears – By Ilya Spivak, Senior Currency Strategist

- Most Asian Stocks Rise, NZD Climb on CPI Expectations at Risk – By Daniel Dubrovsky, Junior Analyst

- Weekly Technical Perspective on the New Zealand Dollar (NZD/USD) – By Michael Boutros, Currency Strategist

- NZD/USD Rebound Vulnerable to Dovish RBNZ Forward Guidance – By David Song, Currency Analyst

--Written by Peter Hanks, Junior Analyst DailyFX