Asian Stocks Talking Points:

- Asian stocks were mostly higher as a new week got under way

- US earnings seem to be supporting these markets despite apparently endless trade war headlines

- The Dollar was underpinned in a calm foreign exchange session

The DailyFX Third-Quarter Fundamental and Technical Forecasts are out now

Asian stocks were mostly higher Monday, seeming to shrug off now ever-present trade tensions. US President Donald Trump suggested on Sunday that America was winning a trade war with China, but Beijing has threatened retaliatory tariffs on $60 billion of US imports.

Still, regional equity markets appeared to focus rather on last week’s Wall Street gains, which came in turn on earnings optimism. The Nikkei 225 was up 0.2% in the middle of the Tokyo afternoon. Australia’s ASX 200 was in the green to the tune of 0.5%, with its plentiful mining names given a lift by higher iron-ore prices. The mainboards of Hong Kong and Seoul also looked perky with only the Shanghai composite betraying possible trade nerves- it was off by 0.7%.

The US Dollar was steady against major peers. There was no first-tier Asian economic data to move foreign exchange markets. However, last week’s news of a fall in the US employment rate – despite forecast-missing job creation- still seems to be underpinning the greenback.

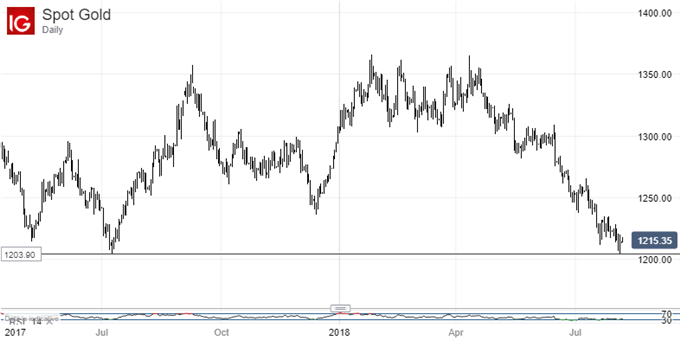

Crude oil prices gained, reportedly as markets looked to forthcoming details of new sanctions against major producer Iran. Gold prices inched higher through the session. The oldest haven’s prices have been falling steadily since April and are now back very close to lows not seen since July 2017. Rising US interest rates have weighed steadily on non-yielding gold, with trade tensions so far apparently providing it with little support.

Still to come on what is admittedly a very light data slate Monday is the Purchasing Managers Index from Germany’s construction sector and a look at Eurozone investor confidence. The schedule will be more crowded as the week progresses, however, with interest rate decisions due from both Australia and New Zealand among the likely highlights.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!