EURUSD – Prices, News and Technical Analysis

The latest IG Client Sentiment Indicator shows how retail are positioned in EURUSD and how daily and weekly changes can affect trading decisions.

The DailyFX Q3 forecasts and analysis of USD and EUR are available to download here.

EURUSD Rallies Remain Capped

EURUSD goes into today’s FOMC meeting on the backfoot with recent rallies providing better selling levels for traders. Today’s meeting is expected to be reasonably quiet – the next 0.25% interest rate hike is fully priced in for the September meeting – but Fed Chair Powell’s press statement is likely to confirm the strength of the US economy. Powell may also confirm the central bank’s independence after US President Trump’s recent comments on the strength of the US dollar, removing any political hurdles from the central bank’s hiking intentions.

US 2-year Treasuries currently offer 2.675%, and this yield will track interest rates higher, while the Eurozone equivalent, the German 2-year, continues to trade with a negative yield (-0.57%). This differential, and the German curve is negative all the way out to 6-years, will continue to see money flow from the euro to the US dollar, weakening the single block’s currency.

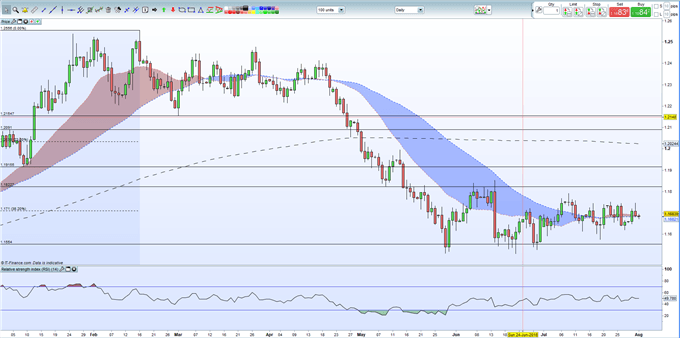

EURUSD touched a one-week high of 1.1746 on Tuesday before quickly retreating below 1.1700. The pair now sit on the 20- and 50-day moving average and may fall back further if the FOMC releases a hawkish statement. The upside for EURUSD remains at 1.1791, the July 9 high, while the November 7 swing low at 1.1554 remains a medium-term target for bears. The double-low just above 1.1500 should provide solid support for the pair.

EURUSD Daily Price Chart (January – August 1, 2018)

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on EURUSD? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

--- Written by Nick Cawley, Analyst