Talking Points:

- The iPhone maker is part of the larger FAANG group and FAANG+ Index

- Revenue was $53.3 billion versus $52.42 billion expected from analysts

- The positive earnings and outlook helps to push the company’s market cap nearer the $1 trillion mark

Third Quarter Forecasts for Currencies, Commodities and Equities are out! They can provide useful insight to Enhance Your Trading Opportunities.

Apple Earnings Provide Relief for FANG

Apple earnings for Q2 carried even more weight than usual on Tuesday, with the market looking to the mega-cap stock for direction. Recent tech earnings have disappointed and the Seattle based giant was the last to deliver their performance. Revenue came in at an impressive $53.3 billion, surpassing estimates of $52.42 billion. Earnings per share was similarly strong, at $2.34 versus $2.18. Importantly, 41.3 million iPhones were sold, narrowly missing the 41.6 million forecast.

Consult our NASDAQ page for charts and coverage of the tech-heavy US index.

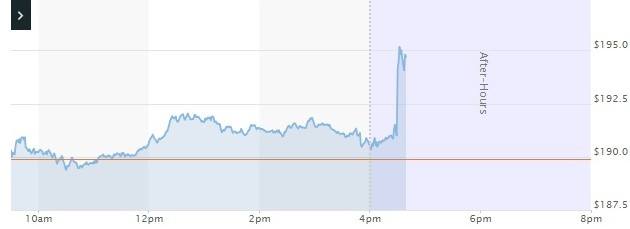

Shares rose in after-hours trading, climbing roughly 2% at the time of release. The stock still remains short of the $203.45 mark it would need to reach to hit a market capitalization of $1 trillion, but approached $195. At current valuation, the company maintains a commanding lead in the race, valued near $966 billion versus the $866 billion of Amazon and $815 billion of Microsoft.

The performance from Apple will look to end the recent trouble felt by FANG and the larger FAANG group due to the precipitous drop from Facebook and disappointing miss from Netflix. Amazon and Google avoided disappointing earnings but were dragged lower in recent days as the tech sector saw investors look elsewhere for yield.

Apple Price Chart: After-Hours (July 31, 2018) (Chart 1)

Chart from Marketwatch

Despite the trouble they recently encountered, US equities posted solid gains for the month. Similarly, equities were higher Tuesday, awaiting the results of Apple. Heading into the latter half of the week, a slew of significant market moving information is due. Most notably, the FOMC is due for a decision on Wednesday and the BoE on Thursday. The remaining economic data is available on our economic calendar, updated immediately upon each data release.

--Written by Peter Hanks, DailyFX Research