Gold Price News and Analysis

The DailyFX Q3 Gold Forecast is now available to help traders navigate the market.

Gold Price Analysis – Chinese Yuan Weakness Continues to Hurt Gold Bulls

The price of gold has fallen nearly $150/oz. since touching a $1,365/oz. high just over three months ago as tightening US monetary policy and a weak offshore Chinese Yuan continue to hurt bullish gold investors. The CNH-gold correlation remains tight and is unlikely to be broken in the short-term, especially with tighter US monetary policy weighing on both asset classes. The Chinese Yuan is around 9% lower since US President Donald Trump ramped up trade tariff rhetoric, negating the overall effect of Trump’s tariffs on the Chinese economy. The ongoing US-China trade war will continue to be a driving force for both the Chinese Yuan and gold.

Special Report: US-China Trade War Enters New Phase amid Yuan Depreciation.

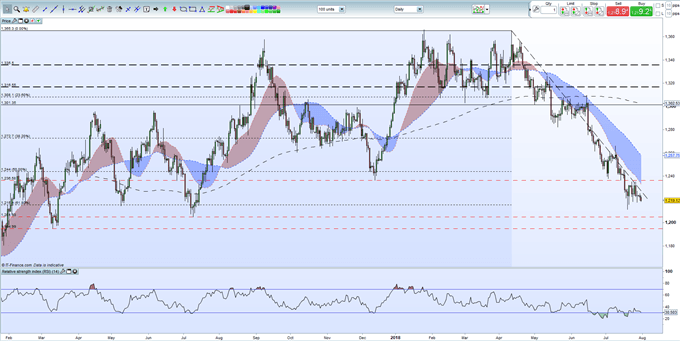

Gold Remains Stuck in a Technical Downtrend

We have noted before that gold is stuck in a downtrend started on April 11 when the precious metal traded at a high of $1,365/oz. The next level of support remains at $1,204/oz. and is likely to hold in the short-term and this roughly coincides with the politically sensitive USDCNH level of 7.00. USDCNH currently trades at 6.8400. If USDCNH holds below 7.00, gold may get a short-term boost, something that would please gold investors who remain overwhelmingly long of XAU.

Spot Gold (XAU) Daily Price Chart (February 2017 – July 31, 2018)

The latest IG Retail Sentiment Indicator shows that traders are 87% net-long of the precious metal, a bearish contrarian sentiment indicator.

Are you new to Gold or FX trading or are you looking to improve your trading skill sets? We can help you along your journey with a comprehensive range of constantly updated guides and trading tools – they are all Free to Download Here.

We are interested in your opinion on Gold – Please share your thoughts, views or analysis with us using the comments section at the end of the article or you can contact the author via email at nicholas.cawley@ig.com or via Twitter @nickcawley1.

--- Written by Nick Cawley, Analyst