GBPUSD Prices, News and Analysis

- Market expectations hit 86% for a UK rate hike this week.

- Sterling is expected to remain capped until Brexit path becomes clearer.

IG Client Sentiment shows retail are 69.1% net-long GBPUSD and have remained net-long since April 20 when the pair traded near 1.40029, around 6.4% higher than current levels.

GBPUSD Continues to Struggle

Sterling remains stuck around GBPUSD 1.3025 despite the market looking for a 0.25% interest rate hike from the BoE on Thursday. Market expectations of a rate increase have grown to 86% indicating a 0.25% hike is fairly certain on ‘Super Thursday’. Yet the British Pound continues to trade near multi-month lows against the US dollar as Brexit talks stall. The recent UK White Paper has been rejected by the EU, casting doubt over a frictionless trade agreement, leaving UK PM Theresa May in a difficult situation, especially with the ruling UK party split, and vocal, over the UK’s plans to leave the EU. Unless progress is made soon on future trade terms, the likelihood of a No-Deal Brexit will increase with the UK opting for WTO trade terms when they leave the EU on March 2019.

The UK has found an ally in their quest for a frictionless free-trade agreement with the EU in Italian deputy Prime Minister Matteo Salvini, who recently said that he would push for a good deal for the UK in negotiations.

GBPUSD’s current weakness is also a by-product of continued dollar strength, as the US economy expands at a rapid pace. Ahead in the US, the FOMC meeting on Wednesday will see Jerome Powell update on the economy - ahead of a September rate hike - while Friday will see the latest US non-farm payroll release with the US employment rate expected to grow further.

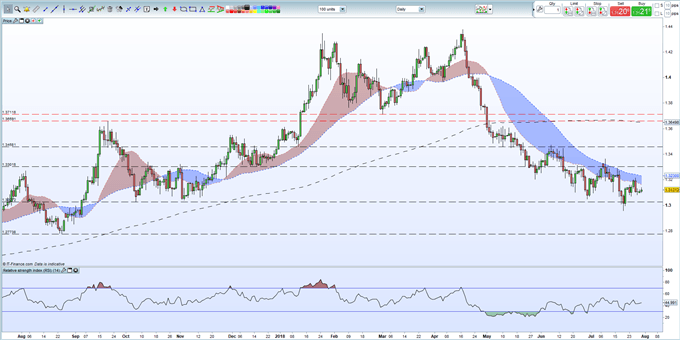

The 1.3020 support level looks set to hold for now although a break and close below would open up a further fall back to the August 24, 2017 low at 1.27738. GBPUSD trades below all three moving averages and remains susceptible to further selling.

We have recently released our Q3 Trading Forecasts for a wide range of Currencies and Commodities, including GBP and USD.

GBPUSD Daily Price Chart (July 2017 – July 30, 2018)

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1