EURUSD Analysis and Talking Points

- Weak French GDP has increased the risks to the downside for next weeks Eurozone GDP

- Strong US GDP to Add Pressure to EURUSD

See our Q3 EUR forecast to learn what will drive the currency through the quarter.

First Signs of Q2 GDP for Euro-Area Looking Weak

This morning participants digested the latest French GDP data for the second quarter, in which both the Q/Q and Y/Y readings underwhelmed expectations due to a series of strikes in the Euro Area’s second largest economy. This is the first published Q2 GDP estimate for a Eurozone economy and it points to downside risks for the data for the region as a whole due next week. The continued sluggishness in France also comes at a period of uncertainty marked by the global trade tensions.

Strong US GDP to Add Further Pressure to EURUSD

Later today we will see the US Q2 GDP, which is expected to surpass 4% for the first time since Q3 2014. Throughout the week, reports have suggested that the GDP figure could as strong as 4.8%. If indeed that is the case, this will likely provide added pressure to EURUSD, which is already reeling from yesterday’s ECB meeting whereby the Draghi stuck with the guidance that rates will remain at current levels through Summer 2019. Consequently, this has led to the continued widening of US-German bond spreads which have continued to move in favour of EUR selling.

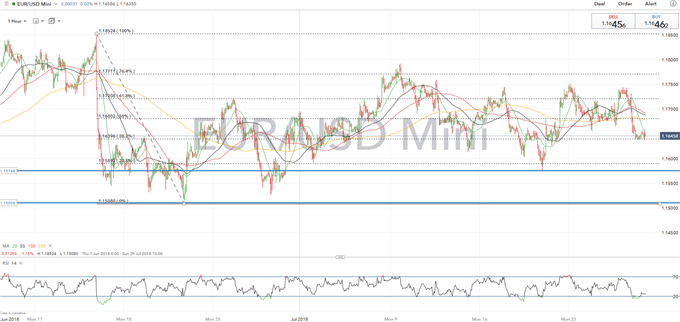

EURUSD PRICE CHART: 1-Hour Time-Frame (June-July 2018)

EURUSD continues to trade within its 1.1850-1.1580 range with no signs of a break-out. Although, US GDP may prompt EURUSD selling on a strong print, support remains situated from 1.1570-1.16 which could possibly stem the declines, while on the upside key resistance sits at 1.1720.

What does Client Positioning Tell us About EURUSD?

IG client data shows 55.7% of traders are net-long with the ratio of traders long to short at 1.26 to 1. The number of traders net-long is 4.7% higher than yesterday and 1.2% lower from last week, while the number of traders net-short is 10.0% lower than yesterday and 7.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX