TALKING POINTS – AUSTRALIAN DOLLAR, CPI, INFLATION, RBA TRADE WAR

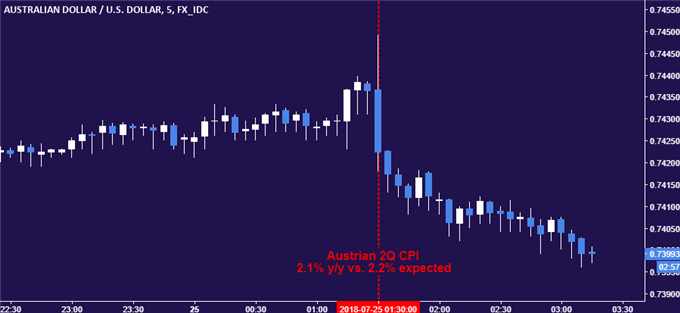

- Australian Dollar down after Q2 CPI underwhelms expectations at 2.1% y/y

- Local bond yield drop hints soft data cooled RBA interest rate hike speculation

- Trade wars now in focus as Trump meets Junker, WTO weighs US/China spat

See our free guide to learn how to use economic news in your AUD/USD trading strategy !

The Australian Dollar depreciated against its US counterpart, falling alongside local bond yields as CPI data put inflation at a lower rate than economists expected. The headline on-year price growth rate printed at 2.1 percent in the second quarter, undershooting forecasts calling for a print at 2.2 percent. The markets’ response to the outcome suggests that it probably cooled RBA interest rate hike speculation.

The markets had already dismissed the likelihood of a rate hike in 2018 before the CPI release. Indeed, priced-in bets suggested an increase will come no sooner than July 2019. The probability of such an outcome ticked down to 52.2 from 57.8 percent after CPI data crossed the wires, implying a slight dovish adjustment in the baseline outlook. In fact, the likelihood of a rate hike at all scheduled RBA meetings between now and the end of next year shifted a bit lower.

In any case, the fallout from the brewing trade war between the US and China may dramatically alter the RBA’s calculus between now and when a rate hike might appear. China is Australia’s top trading partner. If trade tensions hurt growth there, negative knock-on effects on Australian performance may delay rate hikes even further or alter the central bank’s cautious tightening bias altogether.

With that in mind, the markets may now focus on the upcoming meeting between US President Donald Trump and European Commission President Jean-Claude Junker as well as the gathering of the WTO General Council for a temperature check on global trade war developments. The former will offer a view on Mr Trump’s willingness to strike a bargain while the latter will address the on-going US/China spat.

AUD/USD TRADING RESOURCES:

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst, DailyFX