We recently released our 3Q forecasts for the US Dollar in the DailyFX Trading Guides page

US Session Developments – USD Comeback, Bond Yields Soar

After the US Dollar’s worst single day performance in about four months, the greenback put in a partial recovery on Monday as fears about President Donald Trump and his disdain for the Fed’s tightening path subsided. Over the weekend, Treasury Secretary Steven Mnuchin noted that the president ‘fully supports’ the central bank’s independence.

The rise in the greenback occurred alongside with local government bond yields rising across the board, hinting at firming Fed rate hike expectations. In fact, the 2-year yield had its strongest single day performance in about six weeks. This also resulted in the highest rate since late-July 2008, almost 10 years ago.

As a result, pressure was put against similarly high yielding FX such as the Australian and New Zealand Dollars which failed to gain during the US trading session despite a rise in stocks. The S&P 500, which did gap lower, finished the day 0.18% higher. It was led by financials and information technology as traders eyed rosy US earnings. Google’s beat estimates as well as its parent company, Alphabet Inc.

A Look Ahead - Yen May Fall as Stocks Rise

A rather quiet economic data offering for Tuesday’s Asia/Pacific trading session puts risk trends at the forefront of potential market dynamics. The anti-risk Japanese Yen, which pared some gains from the first half of Monday’s session, could weaken if local stocks echo US strength. This also allows room for the sentiment-linked AUD & NZD to rise unless USD gains continue.

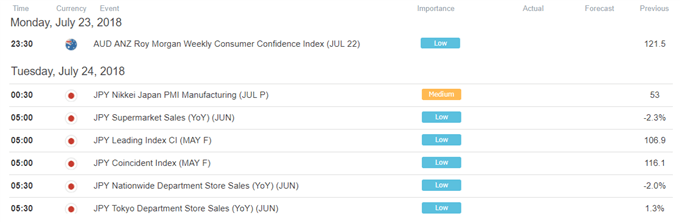

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

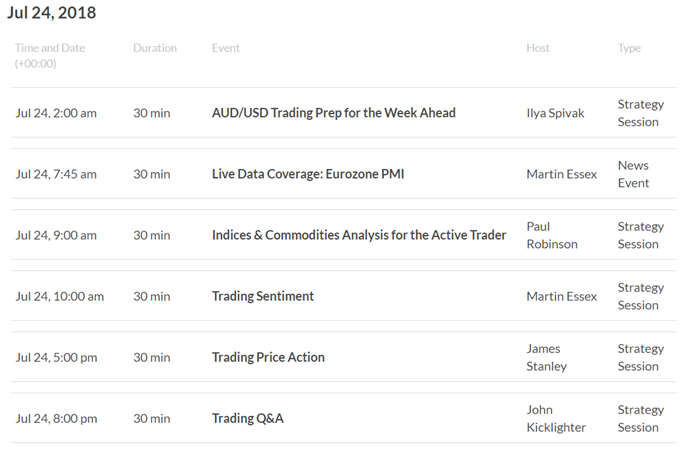

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

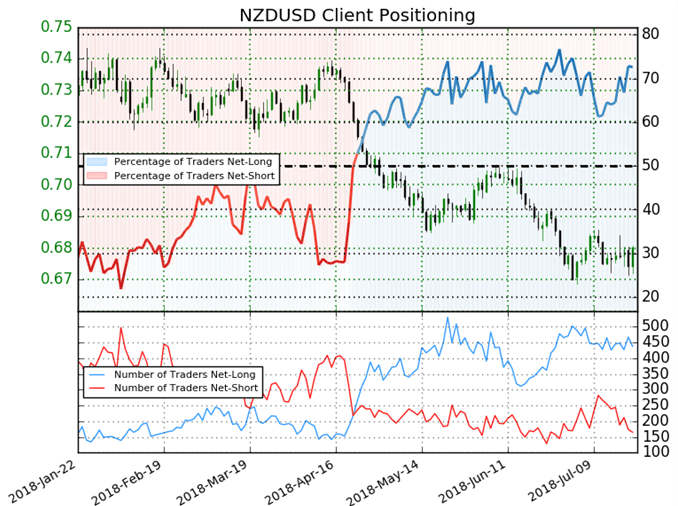

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 72.6% of NZD/USD traders are net-long with the ratio of traders long to short at 2.65 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.73681; price has moved 7.7% lower since then. The number of traders net-long is 3.3% lower than yesterday and 1.9% higher from last week, while the number of traders net-short is 18.7% lower than yesterday and 35.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

Five Things Traders are Reading:

- Google’s Earnings Beat Breathes Life into FANG, US Equities Peter Hanks, DailyFX Research Team

- AUD/USD Outlook Hinges on Australia Consumer Price Index (CPI) by David Song, Currency Analyst

- FX Week Ahead: Australian CPI, ECB Rate Decision, US GDP by Christopher Vecchio, CFA, Sr. Currency Strategist

- US Dollar Grasps for Air as EURUSD Finalizes Triangle Wave by Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

- AUD/USD Technical Outlook: Aussie Holds Critical Price Support by Michael Boutros, Currency Strategist

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter