- UK rate setter Ben Broadbent speaks after the UK market close on Monday

- ECB, President Trump, US Q2 GDP will add volatility over the week ahead.

The New DailyFX Third Quarter Forecasts are now live including a fresh look at GBP, EUR and USD.

UK Markets will be Watching Events Abroad with Interest

Bank of England deputy governor Ben Broadbent speaks late in the UK session on the history and future of QE to the London Society of Professional Economists, the last official UK central bank speaker before the purdah period ahead of next Thursday’s ‘Super Thursday’. The BoE is now expected to lift interest rates by 0.25% with the market currently indicating a 73% chance of a hike on August 2.

The ECB are fully expected to leave all monetary policy levers untouched this Thursday ahead of the latest press conference where questions on QE and the possible timing of a rate hike next year will test President Draghi. On Friday, the first look at US Q2 GDP with current expectations of a robust 4.3% growth will test US dollar bears and may negate recent green back underperformance, sparked by yet another round of US President Trump tweets.

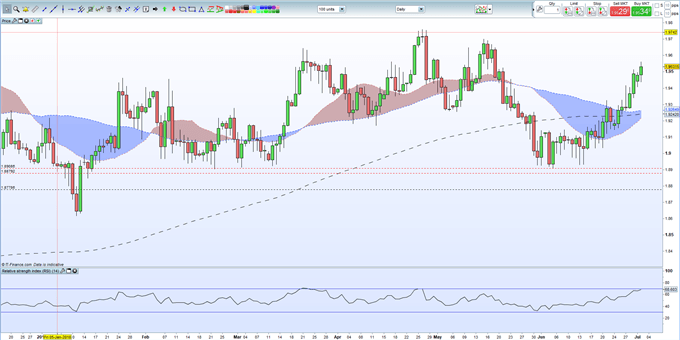

GBPAUD traders will be keen to see the release of Q2 CPI on Wednesday with the pair now trading below the 20, 50- and 200-moving averages and eyeing further falls to the recent double-low just below 1.7400. Ahead of this, 38.2% Fibonacci retracement at 1.76127 will act as a brake if Australian inflation beats on the upside. We look for 2.2% Y-o-Y for the second quarter, up from a prior 1.9%.

GBPAUD Daily Price Chart (May 2017 - July 23, 2018)

If you missed this webinar and would like to know about future events, you can see the full DailyFX webinar schedule here.

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, Educational and Trading Guides and the constantly updated IG Client Sentiment Indicator.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1