Talking Points:

- Google beat on revenue and earnings per share, before accounting for fines, sending the stock higher in after-hours trading

- A recent EU anti-trust fine will cost the tech-giant $5 billion, Google will file for appeal

- Alphabet 2Q revenue grew $26.24 billion versus $25.55 billion forecasted

As the overarching, US equity bull phase approaches a decade, earnings season is an opportunity for corporations to do their part in extending it. Starting this week on a strong footing Monday, Google released earnings figures for 2Q 2018, posting a beat and subsequently climbing in after-hours trading. Against an expected revenue of $25.55 billion, Google reported $26.24. Earnings per share including fines came in at $4.54. Factoring out the fines, EPS would have weighed in at $11.75 versus an expected $11.68. Revenue for a year prior was $20.9 billion, also influenced by a fine from the European Commission.

The Silicon Valley giant faces a wave of regulatory scrutiny both domestically and abroad with the European Commission levying a $5 billion fine just days before earnings. The fine is the result of anti-trust violations with Google’s Android mobile operating system. The fine nearly doubles last year’s payment of $2.7 billion to the European Commission. Alphabet said they will look to appeal the $5 billion hit and in the meantime will accrue it as a charge in the second quarter. Moving forward, mobile profits in Europe could be challenged should the appeal fail and competitors gain ground on the Android system.

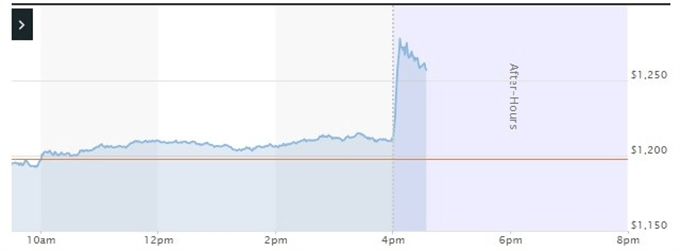

Chart from Marketwatch

Despite the unfavorable adjustment to EPS, investors and traders took the report as a healthy reading with Alphabet shares climbing 6% in after-hours trading before levelling off near 4%. The climb contrasts last week’s miss by FANG member Netflix, which saw its shares drop precipitously. US investors will gain further insight on the health of the tech industry when Facebook and Amazon, the two remaining FANG members, report earnings on July 25th and 26th respectively. If the remaining giants deliver strong performances, US equities may be able to shrug off some of the recent concerns blowing in from trade wars.

To learn about the history of trade wars, read the Brief History of Trade Wars.