Reserve Bank of Australia Minutes, Australian Dollar Talking Points:

- The RBA’s minutes suggested once again that the next rate move when it comes will be a rise

- However, markets do not foresee such a thing for well over twelve months from now

- The Australian Dollar rose, then fell

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now at the DailyFX Sentiment Page

The Australian Dollar rose then slipped again Monday when the Reserve Bank of Australia suggested that the next move in interest rates, when it comes, will probably be a rise. The problem with this ostensibly upbeat message for Aussie bulls is one they’ve long wrestled with- such a thing is not coming anytime soon.

The comment was made in the minutes of the RBA’s July 3 meeting at which the key Official Cash Rate was left on hold at its record 1.50% low for a 23rd straight month- as expected. Back then, the central bank noted as it often does that a stronger Australian Dollar would hamper its chances of boosting stubbornly low inflation and may also impact growth.

The minutes said that a rise was the most likely next move should the economy continue to improve as expected but still left markets with the clear impression that such a move was far from immanent. The minutes also said that it was currently appropriate to hold rate steady, there being ‘no strong case’ for a near-term adjustment in monetary policy.

This however is an old song and interest rate markets don’t in any case foresee any change to Australian rates for the rest of this year and all of next.

Still, the Aussie got a little initial boost, with bulls possibly reassured that the central bank still thinks that, when the times comes, the next move is still thought likely to be upward.

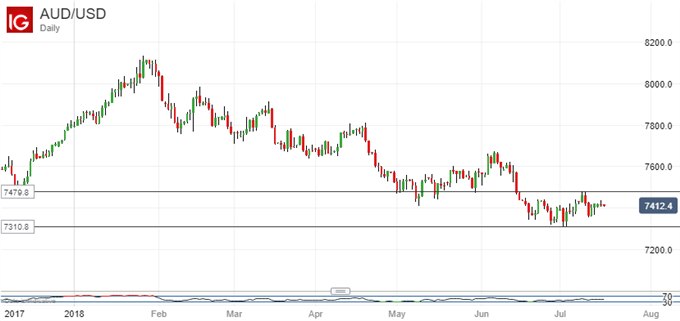

On its daily chart AUD/USD remains very much locked in the long downtrend which has endured since January as those interest-rate differentials have moved to favor the US Dollar.

However, there has been a notable hiatus in this slide over the past couple of months as the pair has settled in to a broad range trade. There is perhaps some sense that the Australian currency has suffered enough for the moment although it seems unlikely that it can be relied upon for any durable gains from here for as long as the prospect of higher Aussie interest rates seems remote.

Despite these minutes, it still does.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!