Talking Points:

- Netflix is the first FANG member to report earnings with the other components due in the coming weeks

- Netflix has climbed over 100% year-to-date and continues to be one of the highest growth tech-stocks

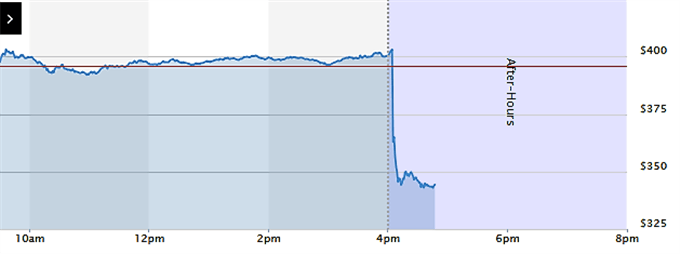

- The company’s shares dropped approximately 13% after hours following the earnings update

- Trade wars will challenge earnings season’s effects on the market as concerns loom

Gain insight on market moving events from our Live Webinars and learn to trade more effectively with our Free Trading Guides.

The California-based media producer Netflix (NFLX) reported second quarter earnings after-hours Monday, driving both the value of its own shares and the Nasdaq at large lower after posting a miss. Netflix shares have climbed over 100% in the year-to-date despite declining 14% after today’s miss and before the release were up roughly 1% on the day.

A large part of Netflix’s recent streak higher has been strong subscriber figures. What was once a boon for the streaming mogul, subscriber growth dissapointed today. Versus forecasted growth of 6.27 million, the company reported only 5.14 million new subscribers in 2Q. Financial figures were much closer to forecasts with revenue missing by just $0.03 billion, coming in at $3.91 billion versus $3.94. Earnings per share surpassed expectations, $0.85 versus $0.79. Netflix management attributed the miss in-part to increased competition and addressed the acquistion of HBO by AT&T. Meanwhile, other competitors continue to pour money into the industry, especially FANG members Amazon and Google.

Chart 1: Netflix, July 16 10AM – 8PM

Chart from MarketWatch

Stay up to date with important economic data with our Economic Calendar.

On a broader scale, the tech-heavy Nasdaq is the best performing of the major three US indices for the year, beating out the Dow Jones Industrial Average and the S&P 500. The Nasdaq is up roughly 14% compared to 4.5% posted by the S&P 500. The strong performance of the Nasdaq could come come into question should other tech stocks post similarly disappointing earnings.

Although the second quarter earnings season began with a strong performance for big banks, it may face headwinds other than those faced by Netflix. Turbulent conditions created by trade wars continue to trouble markets as the tailwind created by federal tax cuts begins to fade. Earnings season will continue for other FANG members Facebook, Amazon, and Google as they report earnings on July 25th, 26th, and 23rd respectively. In the year so far, Netflix surged past the other tech giants but that may change after today’s miss.

---Written by Peter Hanks, DailyFX Research