ASIAN STOCKS TALKING POINTS:

- Asian stocks fell across the board

- News that the US was mulling further sanctions on Chinese imports set the gloomy tone

- The US Dollar was mixed, falling aginast the Yen but rising against the Aussie

The DailyFX Third-Quarter Fundamental and Technical Forecasts are out now,

Trade worries returned to the foreground for Asia Pacific equity markets on Wednesday, with the threat of yet more US barriers against Chinese imports weighing broadly on the indexes, especially of course those in China.

A list of a further $200 billion of goods under consideration for higher tariffs was released with US Trade Representative Robery Lighthizer saying that his office would continue with a period of public notice and invite comment before their imposition. This was enough to see the Nikkei 225 down more than 1% at 0500 GMT. The Shanghai Composite was unsurprisingly hit harder. It was down 1.8%, with stocks in Sydney, Hong Kong and Seoul also lower.

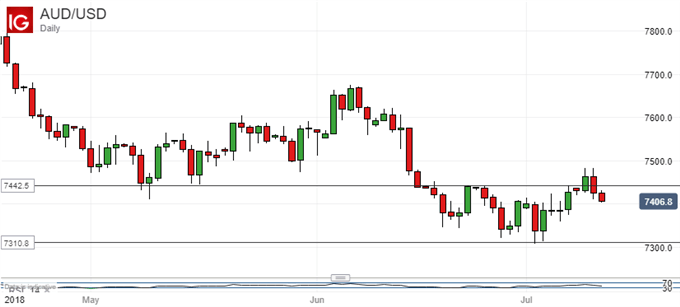

Reduced risk appetite saw the Japanese Yen higher against the US Dollar and the more growth-sensitive Australian Dollar lower. News that Australian consumers were in more buoyant mood in July didn’t manage to lift the currency, with trade clearly in the driving seat. AUD/USD has slipped back below support into its previous trading band, although the band’s base still looks as though it will hold the bears, at least in the short term.

Gold prices edged very slightly lower through the session, while crude oil prices fell too, reportedly as the US consider some waivers on Iran sanctions.

Still to come on Wednesday’s economic data slate is the Bank of Canada’s July interest rate decision, with a quarter-percentage-point rise expected. European Central Bank President Mario Draghi will speak in Frankfurt, while Bank of England Governor Mark Carney will be talking in Boston. Oil inventory data from the US Department of Energy are coming up too.

RESOURCES FOR TRADERS

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!