CAD Analysis and Talking Points

- Canada expected to add 24k jobs for the month of June

- Better than expected jobs report to cement BoC rate hike next week.

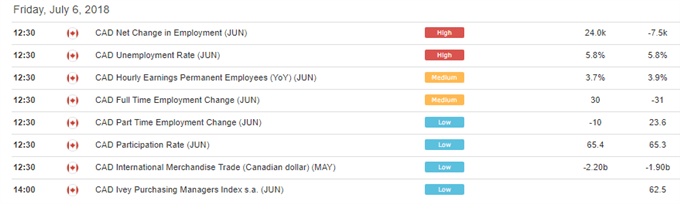

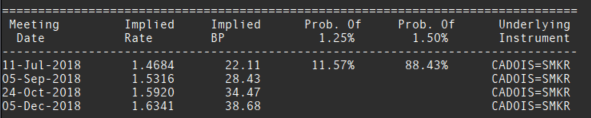

Canada is expected to show a jobs gain of 24k (Low 20k, High 35k) with the unemployment rate standing at 5.8%. A reading above expectations should cement a rate hike by the Bank of Canada next week. As it stands, overnight index swaps are pricing in an 88% chance for the central bank to raise interest rates by 25bps to 1.5%. As such, with a rate hike next week more or less fully priced in, CAD gains may be somewhat limited given the backdrop of trade wars, which in turn weigh on commodity currencies. Focus now for investors will be the longer-term rate path by the BoC with only a 50/50 probability that the BoC will deliver another rate raise.

Source: DailyFX Economic Calendar

BoC Outlook Impacted by Trade Wars

While the Bank of Canada continues to emphasise that they are data dependent, the escalating nature of trade tensions has prompted Governor Poloz to incorporate the impact into their forecasts at the upcoming. Subsequently, while a hike next week is the most likely outcome, there is risk that the BoC end up delivering a dovish hike.

Bank of Canada Rate Hike Expectations

Source: Thomson Reuters

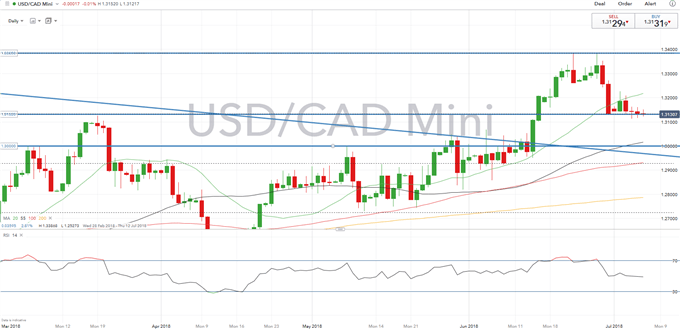

USDCAD PRICE CHART: Daily Time Frame (February 2018-July 2018)

Canadian Dollar Technical Analysis (For a full overview across major Canadian Dollar pairs, click here)

A relatively subdued week thus far for USDCAD with lower volumes leading to somewhat static price action with support at 1.3132 holding for now (61.8% Fibonacci retracement of the 1.3793-1.2061 fall). Nonetheless, the slow grind lower continues for the greenback, which in turn has kept USDCAD on the backfoot, while falling RSI indicators, suggest downside is set to persist. A close below 1.3132 could signal an exacerbation of the USD losses, to make a run in on the 1.30 area. On the upside, key resistance is situated at the 76.4% Fibonacci retracement, at 1.3385, USDCAD has rejected this on two occasions, while near term resistance resides around the 20DMA (1.3220).

IG Client Positioning Sentiment states recent changes in sentiment warn that current USDCAD price trend may soon reverse lower. For full client positioning click here

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX