US Market Snapshot via IG: DJIA -0.6%, Nasdaq 100 -0.7%, S&P 500 -0.6%

Major Headlines

- CSU Leader offers to resign amid row over migration deal

- UK Manufacturing PMI 54.4 vs. Exp. 54

- President Trump slams OPEC for high oil prices

Check out our new Fundamental and Technical Q3 forecast guide for GBPUSD

EUR: Political uncertainty remains prominent for the EU amid reports that CSU Leader Seehofer offered his resignation following a disagreement over Chancellor Merkel’s migration deal. Alongside this, trade war woes continue to weigh on sentiment with the EU threatening to impose retaliatory tariffs on the US if they pursue EU auto tariffs. Consequently, the Euro is on the back foot to begin the week, with EURUSD pulling further away from the 1.17 handle to trade at lows of 1.1630, eyes will be on key support at 1.1500-10.

USD: Despite the risk off sentiment, the Japanese Yen and Swiss Franc are slightly offered against the greenback. The USD showing traits as a safe haven currency given its reserve status, while higher interest rates from the FOMC has helped attract inflows into the USD. However, the greenback looks to be moving towards key resistance zone from 95.30-50, which has continued to curb further advances in the USD. If indeed there is another rejection at these levels, this would likely imply support at 1.1500 for EURUSD and 1.3000 for GBPUSD.

GBP: Largely lower amid the broad gains in the US Dollar, a slight beat on the UK manufacturing PMI provided an initial boost, however gains were short-lived with factory output slowing from the 5-month highs last month, which in turn suggests that manufacturing remained subdued for Q2. Not exactly the rebound that BoE members had been looking, sticking with the BoE, Deputy Governor Jon Cunliffe provided some downbeat comments in regard to the UK economy amid global developments surrounding trade wars and the rising probability of a China credit crisis. A sizeable 1.1bln option expiry at 1.3095-1.3100 likely to garner attention.

CNY/CNH: Against the backdrop of trade wars, more and more attention has been placed on the Chinese Yuan, which continues to weaken and has shown no signs of abating. Since June 15th where the Trump administration stated that $234 worth of Chinese goods will be subject to tariffs from July 6th, the offshore Yuan (CNH) has fallen at a rapid rate with the CNH weaker by over 3.7% against the US Dollar.

Crude Oil: Over the weekend, President Trump stated that he spoke with Saudi Arabia’s King Salman on boosting oil production by as much as 2mln bbls, adding that prices were too high which the Saudi King is said to have agreed with. In reaction to this, oil prices after softer this morning. However, losses have been stemmed amid reports that Libya’s NOC declared a force majeure at a number of key ports, leading to an outage of over 800k bpd.

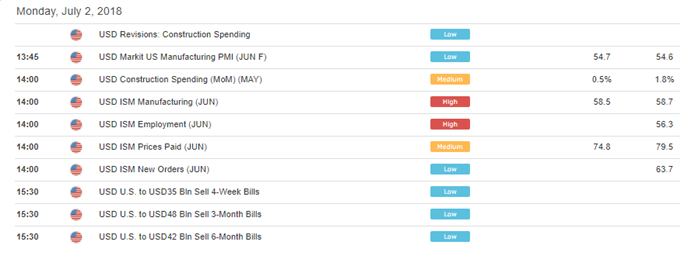

DailyFX Economic Calendar: Monday, July 2, 2018 – North American Releases

DailyWebinar Calendar: Monday, July 2, 2018

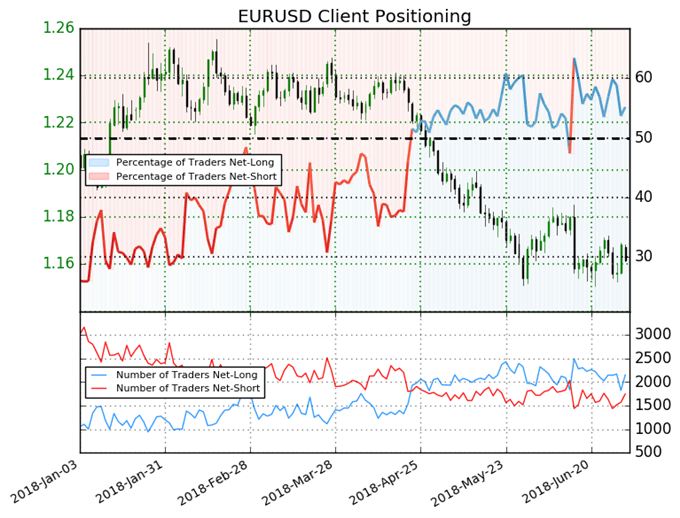

IG Client Sentiment: EURUSD Chart of the Day

EURUSD: Retail trader data shows 55.2% of traders are net-long with the ratio of traders long to short at 1.23 to 1. In fact, traders have remained net-long since Jun 14 when EURUSD traded near 1.17453; price has moved 1.1% lower since then. The number of traders net-long is 10.5% higher than yesterday and 7.4% lower from last week, while the number of traders net-short is 3.7% higher than yesterday and 3.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “CoT Weekly Update - USD Relative Speculative Extremes Persist” by Paul Robinson, Market Analyst

- “UK Market Look Ahead: FTSE, GBPUSD, EURGBP | Webinar” by Nick Cawley, Market Analyst

- “GBP Outlook: UK Manufacturing PMI Beat Provides Ammo for BoE Hawks”by Justin McQueen, Market Analyst

- “Bitcoin & Ethereum Charts – Will Bounces Turn into Rallies or More Selling?”by Paul Robinson, Market Analyst

- “EURUSD Latest: Euro Under Pressure From German Fallout, Trade Wars” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

https://www.dailyfx.com/forex/market_alert/2018/07/02/EURUSD-Latest-Euro-Under-Pressure-From-German-Fallout-Trade-Wars.html?ref-author=McQueen