EURUSD News and Talking Points

- German coalition government rattled further and may not survive.

- US President Trump see leverage in automobile tariffs.

The Brand New DailyFX Q3 Trading Forecasts for all major currencies, commodities and indices, are now available to download to help you make more informed trading decisions.

EURUSD to Move Lower as Headwinds Increase

All is not well in Europe’s economic engine and the euro is set to be hit further lower in the coming weeks. In Germany, Angela Merkel’s ruling coalition government is under threat after CSU party leader and interior minister Horst Seehofer offered to resign in response to the recent EU migration deal. If Seehofer’s resignation is accepted it will call into question the future of Angela Merkel’s government at a time when Europe needs its strongest of pillars. And it is not just internal ructions shaking Germany with the US-EU trade wars seemingly being notched up. Over the weekend US President Trump highlighted again the potential leverage from tariffs against the EU automobile industry, at a time when the sector is still reeling from the emissions scandal and fears over the outcome of a no-deal Brexit. Around 1 in 5 new cars exported from Germany goes to the UK.

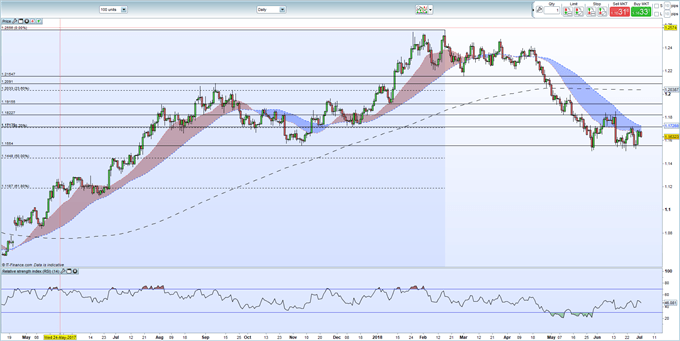

EURUSD continues to respect the 1.1500 area after half-a-dozen failed attempts to break lower. Options barriers and quarter-end re-balancing may have prevented move lower but the charts continue to point to further weakness. The pair trade below all three moving averages while the RSI indicator in mid-market but pointing lower. A break below 1.1504 opens the way to 1.1448 with 1.1187 the longer-term objective.

The latest IG Client Sentiment Indicator shows how retail are positioned in EURUSD and how recent positional changes help retail make better-informed trading decisions.

EURUSD Daily Price Chart (April 2017 – July 2, 2018)

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on the EURUSD?

Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

--- Written by Nick Cawley, Analyst