Talking Points:

- FOMC raises benchmark interest rate to range of 1.75-2.00%, as was expected by markets.

- Fed funds price in an 81% chance of a 25-bps rate hike in September, and odds for December increased from 51% to 57% as Fed Chair Powell’s press conference got under way.

- US Dollar produces bullush reaction, with gains accumulating fastest against the Euro and the Japanese Yen.

Looking to learn more about how central banks impact FX markets? Check out the DailyFX Trading Guides.

At its June policy meeting today, the Federal Open Market Committee as was widely expected when they announced the main overnight benchmark rate would rise into the range of 1.75-2.00%.

The rate move was not a surprise in any sense of the word, given that Fed funds futures were pricing in a 100% chance of a 25-bps hike today; as has become the expectation, the Fed changed its policy when it had a new Summary of Economic Projections in hand.

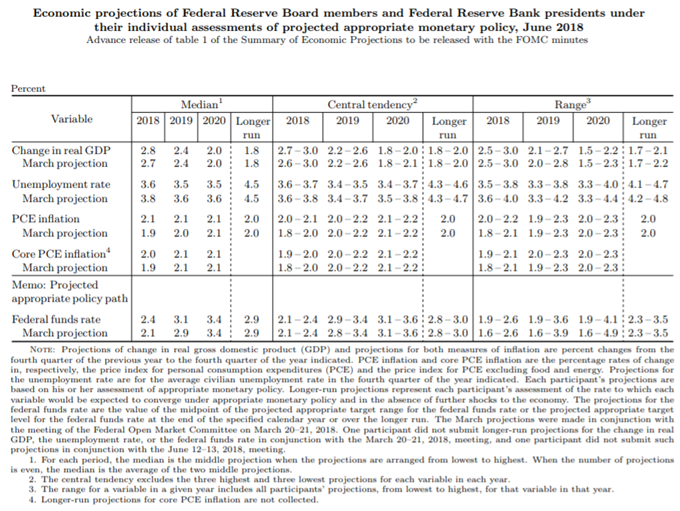

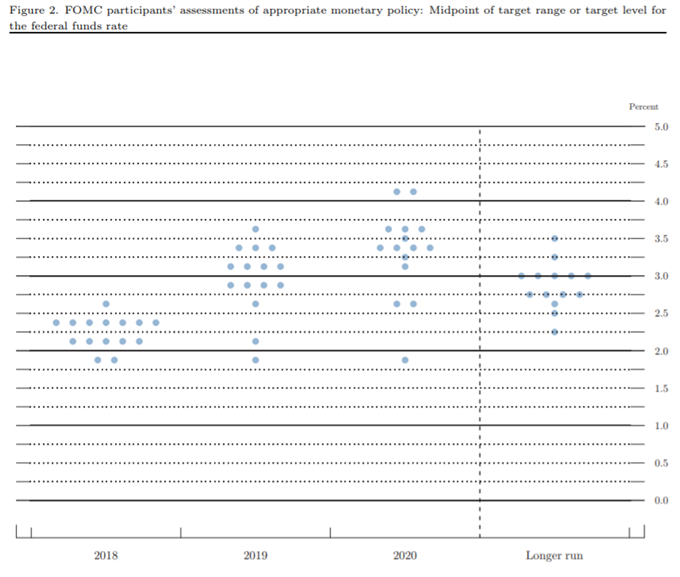

Overall, the FOMC saw the median Fed funds rate at 2.4% at the end of 2018, up from 2.1% at the past five meetings. Likewise, they saw the median Fed funds rate at 3.1% at the end of 2019, up from 2.9% in March 2018. Finally, the median Fed funds rate for the end of 2020 was heldat 3.4%.

In sum, today’s statement can be seen as slightly more hawkish than what markets were pricing in ahead of time, given the upgraded outlook for two more hikes this year and the additional hike being planned for next year.

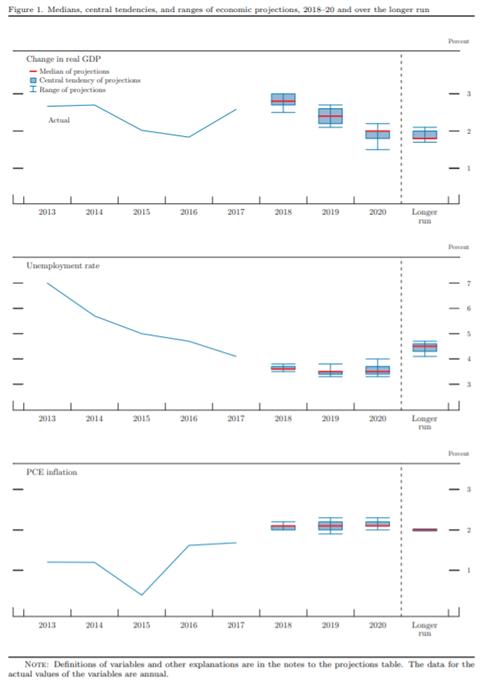

Here are the Fed’s new forecasts:

Here is the Fed’s new dot plot:

See the DailyFX economic calendar for Wednesday, June 13, 2018

USD/JPYPrice Chart: 1-minute Timeframe (June 13, 2018 Intraday)

Immediately following the data, the US Dollar jumpedhigher versus the Euro and the Japanese Yen, with the Dollar Index (DXY) rallying from 93.58 ahead of the FOMC decision to as highas 94.03. The DXY Index was trading at 93.98 at the time this report was written as Fed Chair Powell’s press conference was under way.

Read more: Preview for June FOMC Meeting and Outlook for US Dollar

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX