Current Market Developments – USD Pares Gains on Fed Chair Jerome Powell Speech

All eyes were on Wednesday’s FOMC monetary policy announcement and for the US Dollar initially, the outcome and forward guidance did not disappoint it. The greenback rose aggressively and at one point, was at its highest point since the beginning of this month. What most likely drove it higher? Anticipation of an additional hike by the end of the year and another extra one in 2019.

Wall Street did not take the news well, with the S&P 500 down about 0.40%. This makes sense as tighter credit conditions bodes ill for growth. Then, all was lost for USD afterwards. Not only did it pare its gains, but it also finished the day cautiously lower against its major peers. Looking at its behavior, its descent afterwards very closely aligned with the beginning of the press conference from Chair Jerome Powell.

Mr. Powell began his speech with confirming speculation that the central bank will begin hosting press conferences following every meeting in the year ahead. This anticipation likely helped push the greenback higher in recent months because in the past, the Fed has tended to hike at meetings with press conferences. However, he shot down those hawkish bets when he said that more speeches doesn’t mean anything.

Comments from Jerome Powell:

- To start press conferences at every meeting in January

- Change is about improving communications

- Twice as many press conferences doesn’t signal anything

- Recent rise in oil prices will push inflation above 2%

- Now was an appropriate time to remove forward guidance

- Balance-sheet roll off is proceeding smoothly

- FOMC sees fiscal moves as supporting demand

- Contacts say concerns about trade policy are arising

- Hope we get significant effects from tax cuts

- Part of tepid wage growth explained by low productivity

Given the greenback’s performance, most currencies were cautiously higher against it by the end of the session. The Euro pulled further ahead compared to its major peers. Other high-yielding currencies like the Australian and New Zealand Dollars were also slightly higher against USD.

A Look Ahead – AUD Looks to Jobs Data, Will Asian Shares Echo US Declines?

Ahead, the Australian Dollar faces a local jobs report. In May, Australia is expected to add fewer jobs while the unemployment rate ticks lower to 5.5 percent. As of recently, local economic performance has been tending to outperform against expectations. This opens the door to a better-than-expected outcome. However, gains on such an outcome could be limited given that RBA Governor Philip Lowe said yesterday that a rate increase is ‘some time away’.

Also, keep an eye on how Asian shares react to the FOMC. If they echo declines from the US session, then the anti-risk Japanese Yen could gain at the expense of the New Zealand or Australian Dollars.

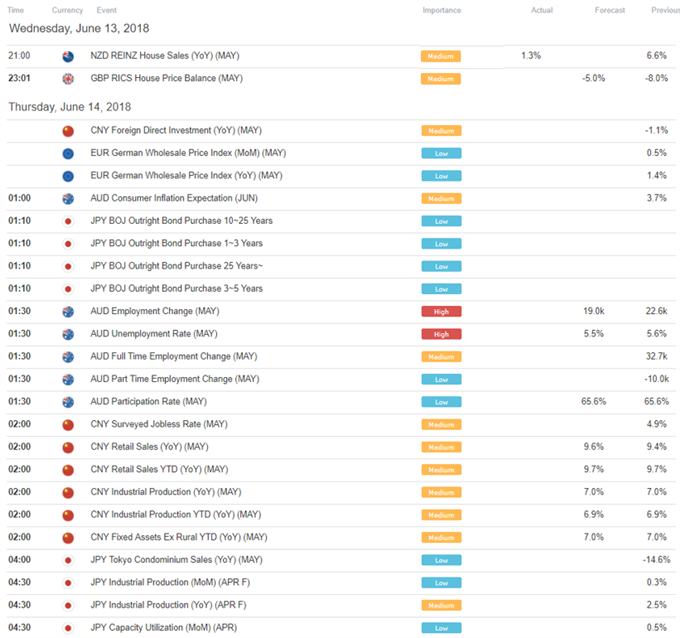

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

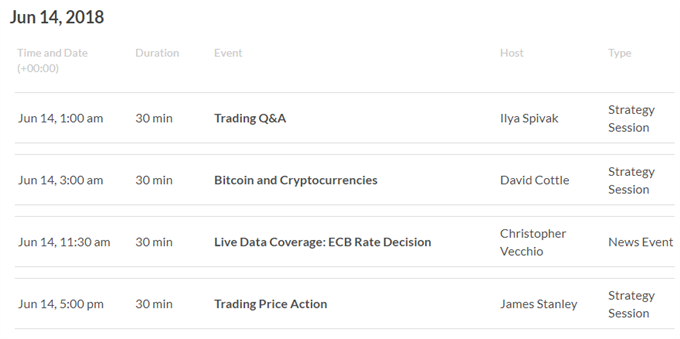

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

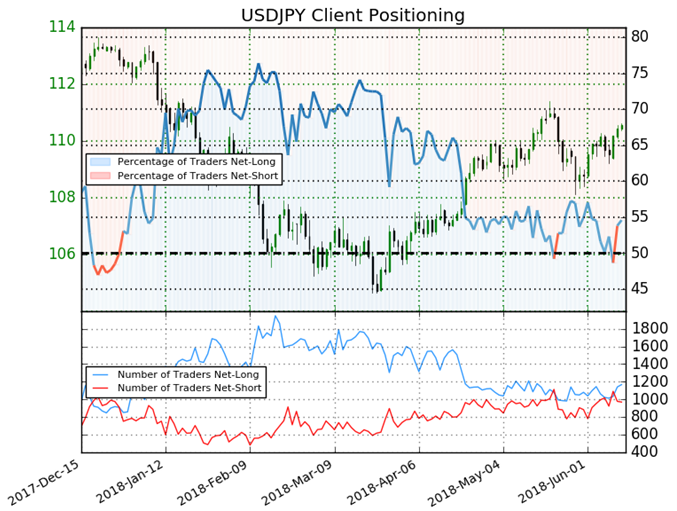

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 54.6% of USD/JPY traders are net-long with the ratio of traders long to short at 1.2 to 1. The percentage of traders net-long is now its highest since Jun 06 when USD/JPY traded near 110.16. The number of traders net-long is 13.3% higher than yesterday and 6.6% higher from last week, while the number of traders net-short is 10.7% lower than yesterday and 2.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

Five Things Traders are Reading:

- Post-FOMC EUR/USD Weakness to Subside on Detailed ECB Exit Strategy by David Song, Currency Analyst

- US Dollar Rips and Dips as the Fed Hikes, Pledges Two More in 2018 by James Stanley, Currency Strategist Analyst

- LTC/USD Technical Outlook: Litecoin Prices Plummet towards Yearly Low by Michael Boutros, Currency Strategist

- US Dollar Gains as FOMC Hikes Rates, Outlines Plans for Two More in 2018 by Christopher Vecchio, Senior Currency Strategist

- Weekly Technical Perspective on the Aussie (AUD/USD) by Michael Boutros, Currency Strategist

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter