Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

US Market Snapshot via IG: DJIA +0.5%, Nasdaq 100 +0.3%, S&P 500 +0.3%

Major Headlines

- Risk sentiment supported as North Korea pledged to shut its nuclear test site in May

- Chinese Manufacturing PMI for April 51.4 vs. Exp. 51.3 (Prev. 51.5)

- UK PM May accepted the resignation of Home Secretary Amber Rudd amid claims that Rudd misled parliament regarding immigration metrics.

- German Inflation at 1.6%, while core measures remain subdued

- Italy's 5 Star Movement leader Di Maio calls for early elections

- US PCE hits 2% inflation target, while core PCE rises at fastest pace in 17-months.

USD: The Bullish momentum seen last week for the US Dollar has continued this morning, which comes ahead of a slew of major risk events, most notably the FOMC rate decision on Wednesday and NFP report on Friday. USD somewhat unfazed by today’s PCE figures which were largely in line with expectations, although the Fed’s preferred measure of inflation rising to a 17-month high will likely provide the Federal Reserve with some encouragement. The DXY looking to make a test for the 92.00 handle with the USD bulls largely finding support from the weaker EUR and GBP. Alongside this, month-end rebalancing models have signaled modest USD buying in the run up to the London FX fix.

GBP: Trend lower in GBPUSD shows no sign of abating amid rising political concerns after Home Secretary Amber Rudd resigned after claims that Rudd had misled parliament regarding immigration metrics. GBPUSD currently eying near-term support at 1.3712 (Mach 1st low), which also coincides with the March 2017 trendline support. Catalyst for 1.3700 will likely be on the upcoming UK PMI data, where investors will be looking to see if there is a rebound suggesting that recent data had indeed been largely impacted by temporary influences as opposed to weak underlying factors in the UK economy.

EUR: The Euro is among the worst performing G10 currencies this morning amid a raft of relatively subdued inflation figures with both Portuguese and Italian inflation printing below expectations. Germany headline CPI figure rose above expectations however the core metrics remained subdued, subsequently posing downside risks towards Thursday’s inflation report. Aside from the data front, Italy’s 5 Star Party leader has called on for a snap election as government talks to form a coalition flounder. EURUSD back below 1.2100, near-term support at last week’s low of 1.2055 before the 200DMA at 1.2050.

DailyFX Economic Calendar: Monday, April 30, 2018 – North American Releases

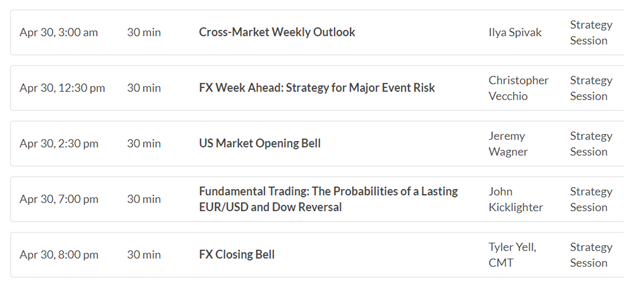

DailyFX Webinar Calendar: Monday, April 30, 2018

Four Things Traders are Reading

- “EURUSD Fails to Find Support From Better Than Expected German Inflation” by Justin McQueen, Market Analyst

- “Euro Forecast: EUR/USD Weakness May Persist as Inflation Rates Decline” by Christopher Vecchio, Senior Currency Strategist

- “A Weekly Technical Perspective on GBP/USD, AUD/USD and U.S. Bonds” by Michael Boutros, Currency Strategist

- “Can the Dollar Stall After a Clear Technical Break?” by John Kicklighter, Chief Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX