Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

US Market Snapshot via IG: DJIA +0.01%, NASDAQ 100 +0.04%, S&P 500 -0.2%

USD: Yesterday saw the 10yr US bond yield break the key 3% level, marking the highest level since January 2014. As such, the momentum for the US Dollar has continued to the upside with a break above the 38.2% (90.86) Fibonacci retracement of the October 2017-February 2018 fall (95.15-88.25), which now sees DXY comfortably above the 91.00 handle. Given the continued push higher in US yields amid the slew of treasury supply hitting the market (eyes on next week’s Q2 treasury refunding announcement), the USD looks ripe for more gains in the short term with the 50% Fibonacci retracement (October 2017-February 2018 fall) in sight for the next upside target.

EUR: More woes for the Euro which currently hovers around the bottom of the 1.2154-1.2556 range that has been in place since January. Alongside the recent poor economic data from the Eurozone which will likely be addressed at tomorrow’s ECB meeting, yield differentials have also pressured the Euro with the 10yr bund/treasury spread hitting a new low and wider by around 240bps. A break through the 2018 range (i.e. March low) could set up a test for near term target 1.2090 (2017 high), before the key 1.2000 handle.

JPY: The Bank of Japan is likely to stick to its usual script with rates left unchanged, which will likely keep USDJPY bulls happy given the continued widening of the US treasury-JGB spread. Alongside this, as we approach the end of the month, investors begin to focus their attention to month-end flows, which currently suggest moderate buying in USDJPY, which could be enough for a visit on 110.00.

AUD: One-way traffic for the Australian Dollar since peaking just above 0.7800. AUDUSD broke below the trend-line support stemming from January 2016, consequently positioning itself for a test of near term support at 0.7530 (Nov’17 low) before a potential move to 0.7500. AUDNZD fell just short of 1.0700 and as such has failed to provide short term relief for AUD.

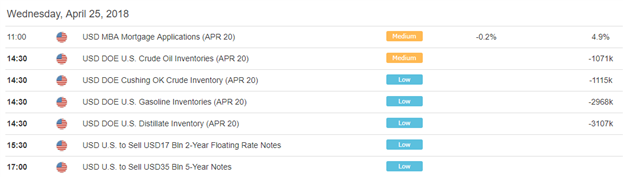

DailyFX Economic Calendar: Wednesday, April 25, 2018 – North American Releases

As is usually the case on a Wednesday, today sees the release of the DoE crude oil report, which is expedcted to show a drawdown of around 2mln bpd. Reminder, last nights API crude report showed a build of 1.1mln bpd. Elsewhere the calendar is somewhat light for the rest of the session.

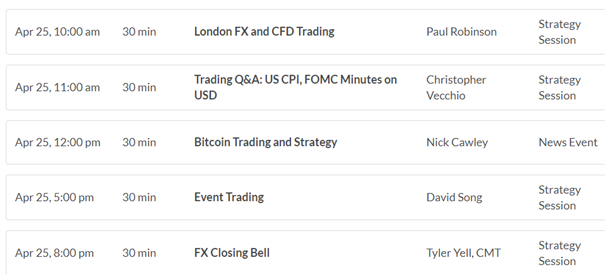

DailyFX Webinar Calendar: Wednesday, April 25, 2018

IG Client Sentiment Index Chart of the Day: EURUSD

EURUSD: Data shows 49.8% of traders are net-long with the ratio of traders short to long at 1.01 to 1. The number of traders net-long is 3.0% higher than yesterday and 41.8% higher from last week, while the number of traders net-short is 9.2% higher than yesterday and 11.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Four Things Traders are Reading

- “US Dollar Continues to Follow Rise in US Treasury Yields; ECB Tomorrow” by Christopher Vecchio, Senior Currency Strategist

- “S&P 500, Dow & Nasdaq Charts Working Towards Completing Tops” by Paul Robinson, Market Analyst

- “Gold Price Likely to Fall Further as US Dollar Reigns” by Nick Cawley, Market Analyst

- “Aussie and NZ Dollars Track Stocks Lower, Yen Sheds Anti-Risk Bid” by Ilya Spivak, Senior Currency Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX