Ripple News and Talking Points

- Ripple’s rally rudely interrupted – further losses may follow.

- Retail sentiment shows traders are overwhelmingly long XRP.

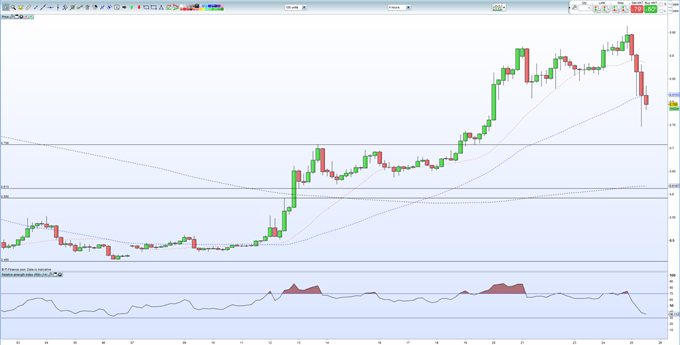

Ripple (XRP) Chart Shows Heavy Daily Loss

After doubling in April – from $0.45 to $0.96 –Ripple met heavy sellers in the last 24 hours and slumped back down to a low around $0.74, painting an ominous technical picture. The sell-off was predicated on media reports that Gary Gensler, the former chairman of the CFTC, suggested that XRP may be classified as a security and that regulators need to bring some clarity to the situation. Although not a new situation – Ripple have previously denied that XRP is a security – the news story hit Ripple hard, highlighting the fragile nature of the recent rally. And with retail customers very heavily long of XRP (See IG Client Sentiment above), further sell-offs may become self-fulfilling as retail jetison the crypto-token.

On the short-term chart support at $0.71 before a chart gap, and the 200-day moving average, between $0.59 and $0.62.

We will be discussing a range of cryptocurrency charts and price set-ups at our Weekly Cryptocurrency Webinar on Thursday at 10:30am.

Ripple (XRP) Four Hour Price Chart (April 2 – April 25, 2018)

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple check out our Introduction to Bitcoin Trading Guide.

What’s your opinion on Ripple – bullish or bearish? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.