Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

President Xi Address at the Boao Forum

Overnight, all eyes had been on Chinese President Xi Jinping address at the Boao Forum. The President took a somewhat conciliatory approach having stated that China will implement major opening steps as soon as possible, while also announcing that they will reduce auto product import tariffs. In turn, this has buoyed risk sentiment with US equity futures pointing to gains of over 1% at the Wall Street.

EUR: Notorious ECB hawk, Ewald Nowotny provided the market the first signs how an interest rate hike may take shape. Nowotny stated that the ECB could lift the deposit rate to -0.2% from -0.4% to start rate normalization process. This caught the market off guard, given that market pricing is for a 10bps as opposed to a 20bps hike for mid-2019, while these comments are also at odds with the ECB, where reports noted that the central bank had been comfortable with market pricing. As such, the latest comments from Nowotny led to the Euro and bund yields spiking towards session highs, with the Euro now consolidating above 1.2350 against the greenback.

GBP: Bank of England speech likely to dominate price action for Sterling, in which rate-setters will look to cement a rate hike for next month. As it stands, OIS markets are pricing in an 80% chance of a rate hike in May. The most hawkish member on the BoE council, Ian McCafferty stated that the BoE should not dally over raising rates modestly going forward and sees an upside risk to the central banks growth forecasts from the Feb QIR. Little reaction seen in GBP in the wake of the comments, given that these comments are in fitting with McCafferty’s usual stance. Additionally, McCafferty (alongside Saunders) had been the hawkish dissenter at the previous monetary policy meeting.

NOK: The Norwegian Krona is notably weaker today after the most recent inflation figures from Norway took a surprise dip, both the headline and core readings missed market expectations. The Norges Bank preferred measure, CPI-ATE printed at 1.2% (Exp. 1.4%), which had been below the central banks own forecast of 1.5% with the metric dragged down by low food prices. However, this is unlikely to derail the Norges Bank from its near-term rate hike path, whereby in the latest monetary policy report, they stated that a hike will happen after summer, suggesting a potential lift off for September.

DailyFX Economic Calendar: Tuesday, April 10, 2018 – North American Releases

US PPI figures printed higher than expectations across the board with the year over year reading touching 3% for the first time since November, following a 0.3% rise for March. Consequently, hinting that inflationary pressure in the US have become more widespread, while in terms of central bank speech, Dallas Fed President Kaplan reiterated that he sees three rate hikes (in line with dot plot projections). Later in the session, investors will see the release of wholesale inventories at 14:00GMT, which is seen falling to 0.6% from 1.1% previously.

As reminder, DailyFX analyst Christopher Vecchio, CFA will be covering the CPI release on Wednesday from 12:15 GMT

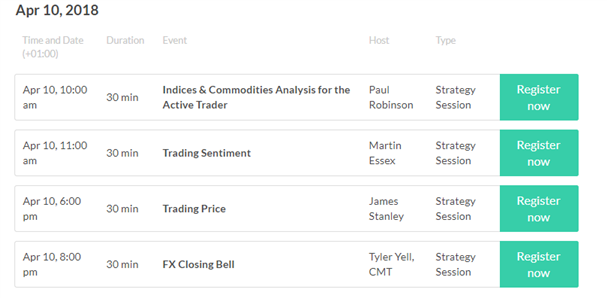

DailyFX Webinar Calendar: Tuesday, April 10, 2018

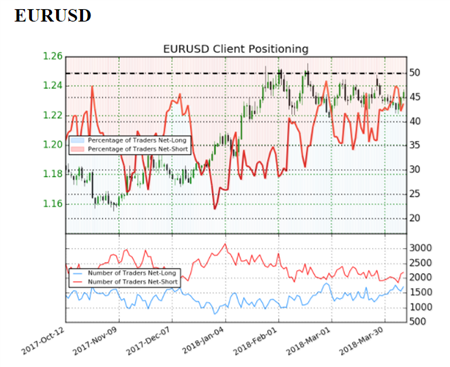

IG Client Sentiment Index Chart of the Day: EURUSD

EURUSD: Retail trader data shows 43.7% of traders are net-long with the ratio of traders short to long at 1.29 to 1. The number of traders net-long is 4.7% lower than yesterday and 12.2% higher from last week, while the number of traders net-short is 11.2% higher than yesterday and 8.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Five Things Traders are Reading

- “GBPUSD Fails to Benefit From Firm UK Economic Data” by Martin Essex, MSTA, Analyst and Editor

- “Technical Outlook – S&P 500, Dow, DAX, US & UK Oil, Gold & More” by Paul Robinson, Market Analyst

- “Gold Ignoring the Chinese Risk-On Memo” by Nick Cawley, Market Analyst

- “US NFIB Dips From Near Record Levels, USD and S&P 500 Unmoved With Focus on China-US Trade Spat” by Justin McQueen, Market Analyst

- “Xi Risk Rally May Not Last Long” by Martin Essex, MSTA, Analyst and Editor

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.

-- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX