Talking Points:

- ISM manufacturing composite missed estimates at 59.3% vs 60.0% expected

- Labor shortages put pressure on output; supplier deliveries face adversities

- The US Dollar Index diped slightly lower following today’s ISM report

- See the DailyFX Economic Calendar for upcoming economic data and for a schedule of live coverage see the DailyFX Webinar Calendar.

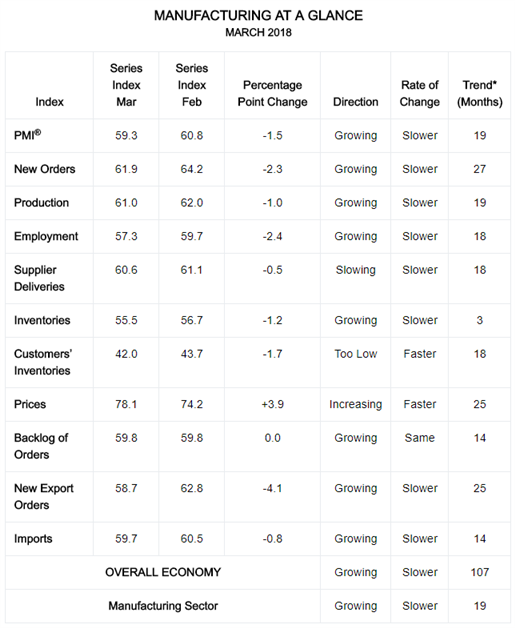

Most ISM Surveys Cool, Excluding Prices

The Institute for Supply Management (ISM) reported that the manufacturing sector survey fell by 1.5% compared to February and now stands at 59.3%. Markets anticipated a decline of only 0.8% as this month’s print missed estimates. Similarly, the New Orders Index fell from the previous month, but by a larger margin at 2.3% coming in at 61.9% in March. The Employment Index continued the downtrend registering a 2.4% loss over February, coming in at 57.3% in March. Contrarily, the Prices Paid index rose by a sizable 3.9% in March at 78.1% compared to the previous figure. This marked its highest reading since April 2011. Raw materials recorded their 25th consecutive monthly increase.

Comments from the Panel

Robust demand remains the theme as the New Orders Index remained above 60 for the 11th consecutive month. This has dragged down the customers’ inventories index to its lowest reading since July 2011. Consumption continued to expand indicating that labor and skill shortages are affecting production output. Supplier deliveries, inventories and imports, were negatively impacted by weather conditions, steel and aluminum disruptions, and equipment shortages.

Asian holidays; lead time extensions; steel and aluminum disruptions across many industries; supplier labor issues; and transportation difficulties due to driver and equipment shortages. Export orders remained strong, supported by a weaker U.S. currency. The Prices Index is at its highest level since April 2011, when it registered 82.6 percent. In March, price increases occurred across 17 of 18 industry sectors. Demand remains robust, but the nation’s employment resources and supply chains are still struggling to keep up.”

See the newly updated fourth quarter forecasts for the US Dollar, Euro, British Pound and more the DailyFX Trading Guides page.

Here are some notable responses from the ISM survey:

- “Significant price increases in the steel commodity due to 232 [the tariffs]. The price increases will begin to impact our company’s performance.”

- “Much concern in the industry regarding the steel and aluminum tariffs recently [imposed]. This is causing panic buying, driving the near-term prices higher and [leading to] inventory shortages for non-contract customers.” (Machinery)

- "International demand is strong for our products in all regions. We are seeing constraints in multiple chemical supply chains due to increased global demand. We are concerned about the impact of tariff and trade wars on demand, but at this time, [there are] no signals that global demand is slowing." (Chemical Products)

- Hiring continues to slowly increase from February into March and capital spending was allowed a small increase. Oil market conditions have improved and continue to stabilize. (Petroleum & Coal Products)

See the full manufacturing survey results below:

Source: March 2018 Manufacturing ISM

Below is a list of economic releases that has driven the US Dollar slightly lower:

- USD ISM Manufacturing (MAR): 59.3 versus 60.0 expected, from 60.8

- USD ISM Employment (MAR): 57.3 from 59.7 previous

- USD ISM Prices Paid (MAR): 78.1 versus 72.5 expected, from 74.2 previous

See the DailyFX economic calendar for Monday, April 2, 2018

Chart 1: DXY Index 15-minute Chart (March 27 - April 2, 2018)

The US Dollar Index has been in a sideways channel throughout the holiday weekend. While ISM did not prduce a substantial reaction in DXY, the index did fall by about 0.14% following the release. At time that this written DXY traded at 89.89.

--- Written by Dylan Jusino, DailyFX Research