Talking Points:

- FOMC raises benchmark interest rate to range of 1.50-1.75%, as was expected by markets (Fed funds futures were pricing in a 100% chance pre-meeting).

- Near-term Fed interest rate glide path remains unchanged from each of the past five meetings: two more 25-bps hikes (for three total) are anticipated in 2018.

- US Dollar produces mixed reaction, with the DXY Index trading lower ahead of newly-minted Fed Chair Jerome Powell’s first press conference.

See our longer-term forecasts for the US Dollar, Euro, British Pound, and other major currencies with the DailyFX Trading Guides.

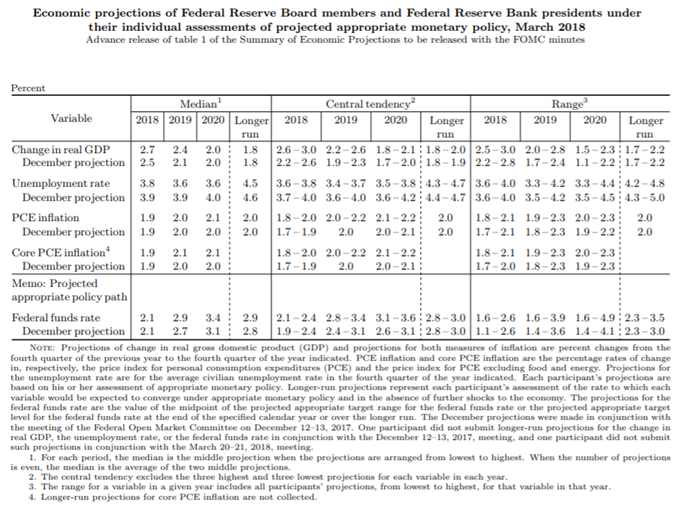

The Federal Open Market Committee did what was widely expected of them today when they announced a 25-bps hike to the main overnight benchmark rate into a range of 1.50-1.75%, as was priced into the market well in advance of today’s policy meeting. The trifecta of improved growth prospects, stable inflation expectations around the medium-term target of +2%, and consistent strength in the labor market made it an easy decision for the FOMC at the first meeting helmed by Jerome Powell.

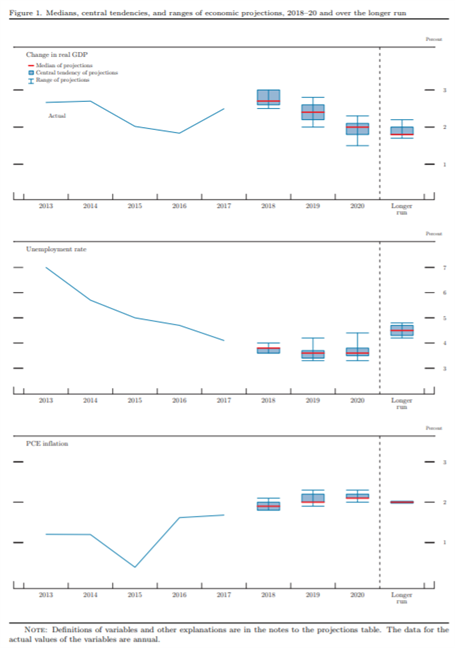

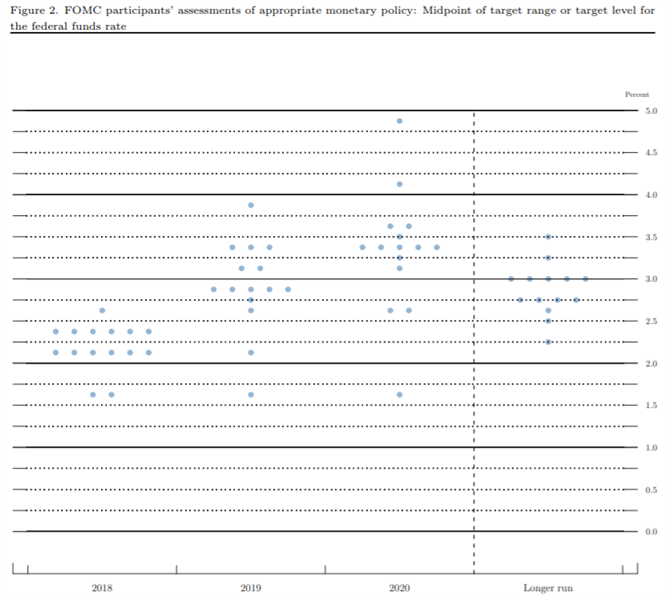

Looking at the summary of economic projections (SEP) and ‘dot plot,’ commentary from the initial FOMC statement suggests that policymakers are more optimistic on the US economy. Policymakers expect “Inflation on a 12‑month basis is expected to move up in coming months and to stabilize around the Committee’s 2 percent objective over the medium term.”

It would appear that inflation could also undercut the Fed’s best laid plans to raise rates two more times this year: “Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.”

Overall, the FOMC saw the median Fed funds rate at 2.1% at the end of 2018, as they have at the past five FOMC meetings. Likewise, they saw the median Fed funds rate at 2.9% at the end of 2019, up from 2.7% in December 2017. Finally, the median Fed funds rate for the end of 2020 was revised up to 3.4% from 3.1%.

In sum, today’s statement can be seen as slightly hawkish than what markets were pricing in ahead of time, given the outlook for two more hikes this year and three for 2019. However, given the balance of risks, the initial decision appears to be a wash for the US Dollar – neither good nor bad.

Here are the Fed’s new forecasts:

Here is the Fed’s new dot plot:

See the DailyFX economic calendar for Wednesday, March 21, 2018

Price Chart 1: DXY Index 1-minute Chart (March 21, 2018 Intraday)

Immediately following the data, the US Dollar slipped back versus the Euro and the Japanese Yen, with the Dollar Index (DXY) dropping from 90.13 ahead of the FOMC decision to as low as 89.86. The DXY Index was trading at 89.96 at the time this report was written.

Fed Chair Jerome Powell begins speak at 14:30 EDT/18:30 GMT; his Q&A should prove more market moving than the initial statement release. Follow the commentary in the DailyFX Real Time News feed.

Read more: DXY Index Trades Sideways into March FOMC Meeting - What to Expect

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher's e-mail distribution list, please fill out this form