To get the Asia AM Digest every day, SIGN UP HERE

The British Pound easily took the spot as Monday’s best performing major. This was thanks to news from EU and UK negotiators that a broad deal on a Brexit transition had been reached. Around two hours later, Sterling was still climbing as UK Brexit Secretary David Davis noted that a “good Brexit deal is close than ever before”.

Another developing story, which helped push the Euro higher, was that ECB policy makers were reported shifting their debate to the expected path of lending rates. Some members also noted accepting that quantitative easing could end this year.

The threat of an ECB stimulus withdrawal in the near-term probably didn’t sit so well with the stock markets. Most European exchanges closed in the red with the Euro Stoxx 50 down 1.24%. The US trading session didin’t fare any better.

There, the S&P 500 and Dow Jones closed 1.42% and 1.35% lower respectfully. This was driven by the decline in the technology sector. There, shares were hurt by reports that Cambridge Analytica retained information on about 50 million Facebook users without the firm’s knowledge.

Despite the decline in sentiment, the anti-risk Japanese Yen ended the day a little lower against its major counterparts. Although, it was little changed against the US Dollar. In addition, the higher-yielding New Zealand Dollar also finished partially higher. This seems to have been the case partially due to general weakness in the greenback throughout the session.

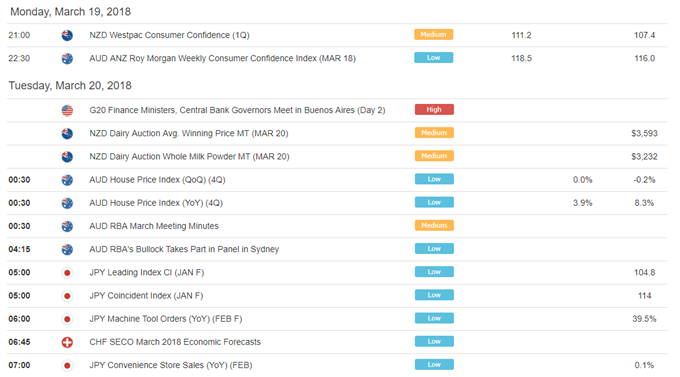

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

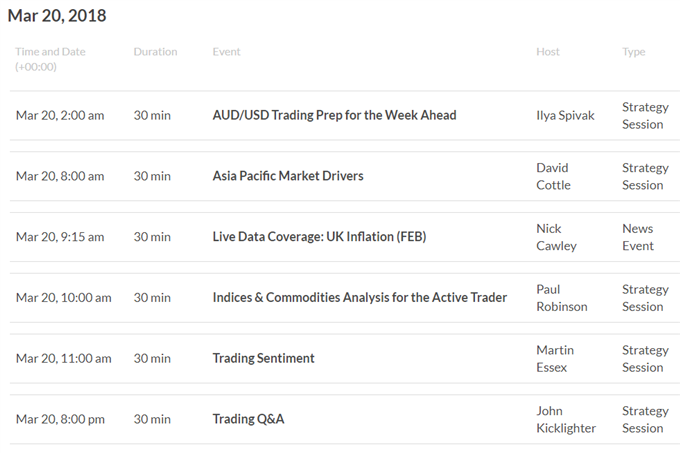

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

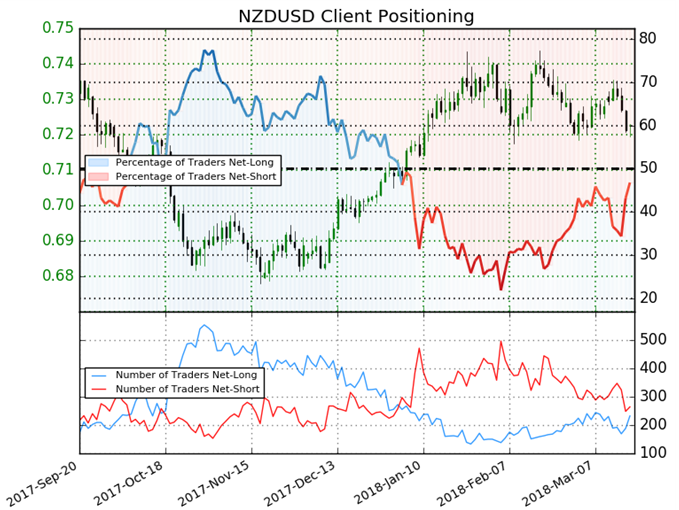

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 46.8% of NZD/USD traders are net-long with the ratio of traders short to long at 1.14 to 1. In fact, traders have remained net-short since Jan 05 when NZD/USD traded near 0.70195; price has moved 3.0% higher since then. The percentage of traders net-long is now its highest since Mar 07 when NZD/USD traded near 0.72862. The number of traders net-long is 22.6% higher than yesterday and 0.9% higher from last week, while the number of traders net-short is unchanged than yesterday and 12.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading:

- GBP/USD: Bullish Breakout Bumps Above 1.4000 Ahead of CPI, BoE by James Stanley, Currency Strategist

- Weekly Technical Perspective on DXY, GBP/USD and NZD/USD by Michael Boutros, Currency Strategist

- US Gives EU Five Conditions For a Tariff Exemption by the DailyFX Research Team

- FX Markets Look to UK & Japanese CPI; FOMC, RBNZ, & BOE Meetings by Christopher Vecchio, Sr. Currency Strategist

- British Pound, US Dollar Are In-Focus Ahead of UK CPI, FOMC and BoE by James Stanley, Currency Strategist

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here