To get the Asia AM Digest every day, SIGN UP HERE

The anti-risk Japanese Yen was the best performing major on Friday, boosted by risk aversion that occurred during the beginning of the session. There, the Nikkei 225 and other indexes declined on reports that US President Donald Trump fired NSA Harold McMaster. However, Trump’s Press Secretary Sarah Huckabee Sanders played down this report soon after.

Sentiment-linked currencies like the Australian and New Zealand Dollars suffered as well. Losses were amplified during the second half of the day when the US Dollar rallied alongside government bond yields, sapping their appeal. Absent a major catalyst, the greenback’s push echoed Thursday’s performance which seemed to reflect pre-positioning for this week’s Fed rate decision. Being the anti-fiat asset, gold prices fell.

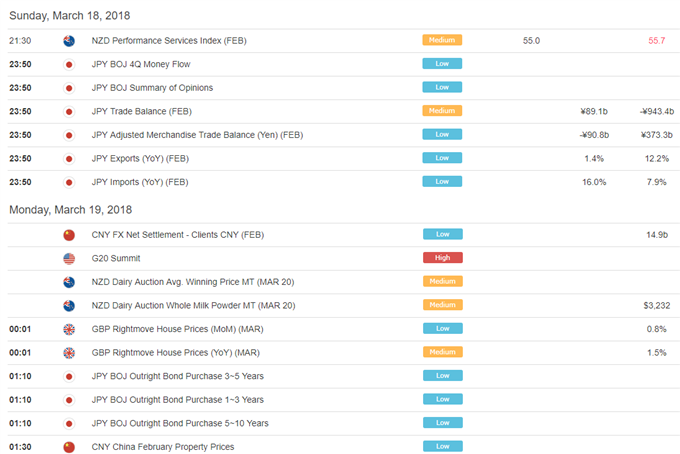

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

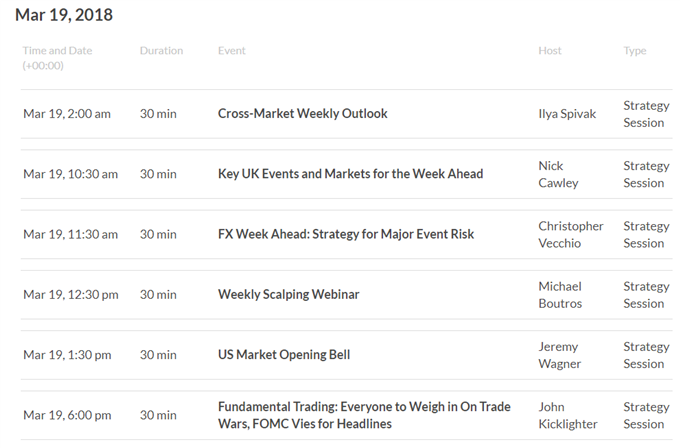

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

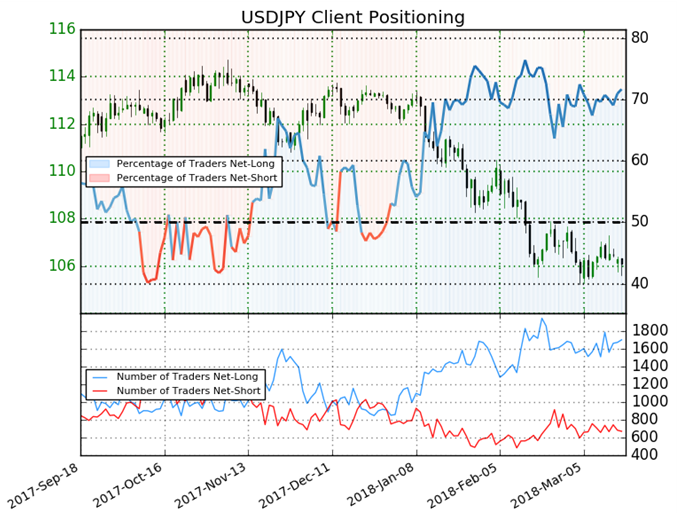

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 71.7% of USD/JPY traders are net-long with the ratio of traders long to short at 2.53 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 112.595; price has moved 5.8% lower since then. The number of traders net-long is 3.3% lower than yesterday and 2.5% higher from last week, while the number of traders net-short is 11.8% lower than yesterday and 1.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

Five Things Traders are Reading:

- EUR/USD Weekly Technical Outlook: Euro Seeking Resolution, FOMC Ahead by Paul Robinson, Market Analyst

- Why the New Zealand Dollar May be More Tradeable Than USD Next Week by John Kicklighter, Chief Currency Strategist

- US Dollar on Offensive Before Fed Rate Decision. Will it Last? by Ilya Spivak, Senior Currency Strategist

- Australian Dollar Pressured, Fed Hawkishness Will Be Decisive by David Cottle, Analyst

- Gold Prices At Risk if Fed Echoes Jerome Powell Outlook At Hike by Daniel Dubrovsky, Junior Currency Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here