Market sentiment talking points:

- Retail traders are heavily long the main cryptocurrencies: Bitcoin, Ether, Litecoin and Ripple.

- From a contrarian perspective, that suggests the price risk is to the downside.

- In this webinar I took a look at the major cryptocurrencies as well as sentiment in other financial markets.

Learn how to trade like an expert by reading our guide to the Traits of Successful Traders

Check out the top trading opportunities for 2018 on the DailyFX Trading Guides page

Downside possible for Bitcoin, Ripple, Ether and Litecoin

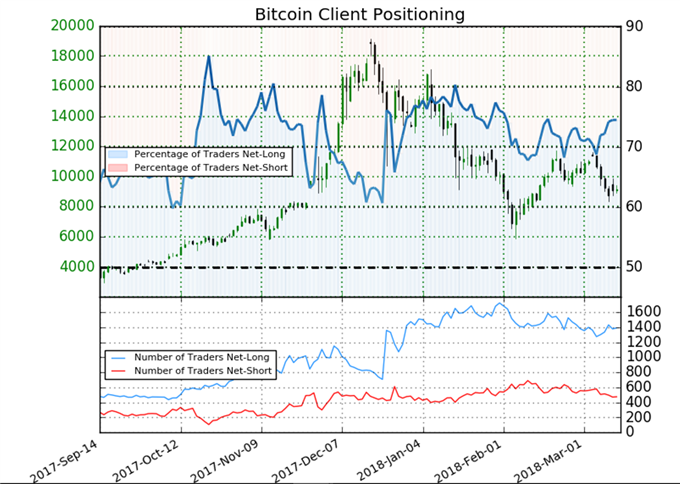

Sentiment data show retail traders heavily long the major cryptocurrencies and from a contrarian viewpoint that suggests their prices could fall back. Here, for example, is Bitcoin.

Bitcoin Price Chart, Daily Timeframe (December 13, 2017 – May 13, 2018)

Bitcoin sentiment chart

Retail trader data show 74.5% of traders are net-long Bitcoin, with the ratio of traders long to short at 2.92 to 1. The number of traders net-long is 0.6% lower than yesterday and 4.7% higher from last week, while the number of traders net-short is 2.1% lower than yesterday and 16.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Bitcoin-bearish contrarian trading bias.

Resources to help you trade the forex markets

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: IG Client Sentiment data, analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance, and one specifically for those who are new to forex.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex