Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The resignation of Gary Cohn, the top economic advisor to US President Donald Trump, has quickly stoked concerns over the onset of a global trade war. The strongest opponent to the aluminum and steel tariffs has been neutralized, leaving the direction of policy in the hands of the “economic nationalists” in the White House. While the US Dollar took the news on the chin, the proliferation of concerns has continued to weigh on the Canadian Dollar and the Mexican Peso, increasingly under pressure amid the NAFTA renegotiations.

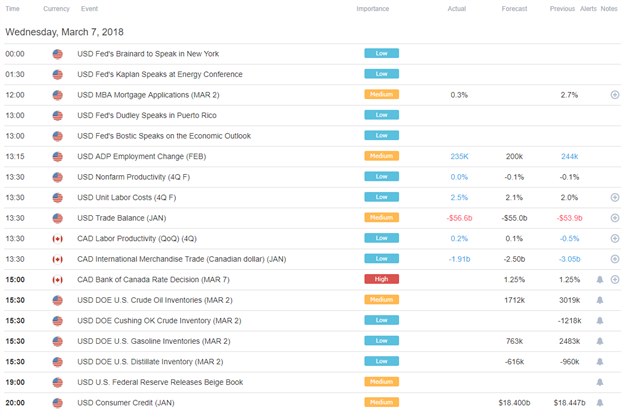

DailyFX Economic Calendar: Wednesday, March 7, 2018 – North American Releases

The Canadian Dollar has been depreciating non-stop over the past six-weeks, and there is no need to look any further than what’s been happening with Bank of Canada rate hike expectations for the first half of 2018. Since mid-January, the odds of a May rate hike (there is no BOC meeting in June) have fallen from 80% down to 55% today. With uncertainty around the NAFTA renegotiations increasing thanks to US President Trump’s commentary about tariffs and a trade war, it seems high unlikely that the BOC will be revisiting the hawkish tone today that carried the Loonie higher in Q4’17 and January 2018.

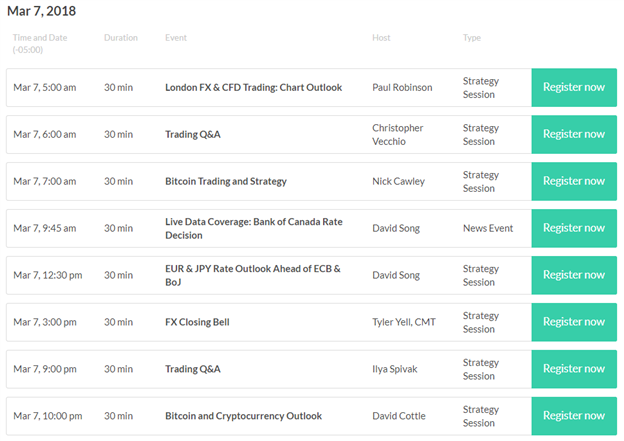

Join Currency Analyst David Song today at 9:45 EST/14:45 GMT for live coverage of the BOC rate decision.

DailyFX Webinar Calendar: Wednesday, March 7, 2018

Five Things Traders are Reading

- “US Dollar Back in Downtrend as Trade War Rhetoric Intensifies” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Bitcoin, Ripple, Litecoin - Latest Charts and Prices | Webinar” by Nick Cawley, Analyst

- “Big Chart Support in Ethereum & Ripple Under Fire, Bitcoin Rolling Over” by Paul Robinson, Market Analyst

- “EURGBP Heads for 0.90 Level as Brexit Concerns Resurface” by Martin Essex, MSTA, Analyst and Editor

- “USDCAD in Focus After Top US Economic Advisor Resigns” by Nick Cawley, Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.