Bitcoin, Ripple, Litecoin News and Talking Points

- Bitcoin and Ripple are testing important support levels

- Litecoin continues to battle the recent sell-off and may out-perform its peers.

Cryptocurrency traders should read the Traits of Successful Traders guide to find out about market ‘best practice’

Bitcoin (BTC) Remains in a Down Trend

The ongoing cryptocurrency sell-off has pushed Bitcoin to the bottom of a noted support zone with a break and close below this opening the way to the next level of support nearly $800 lower. Price action is still respecting the down channel from the December 17 high, while Sunday’s close in the highlighted Zone One on the chart below also suggest further Bitcoin weakness ahead. On the upside, $9,900 is the first resistance ahead of $10,680 – the bottom of Zone Two - and the 61.8% Fibonacci retracement level at $10,971.

Bitcoin Price Chart Daily Time Frame (September 19, 2017 – February 26, 2018)

Retail Traders Still Long Bitcoin But Outlook Mixed

IG Client Sentiment data show 71.2% of traders are net-long with the ratio of traders long to short at 2.47 to 1. The number of traders net-long is 3.8% higher than yesterday and 7.1% lower from last week, while the number of traders net-short is 0.5% higher than yesterday and 15.9% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Bitcoin trading bias.

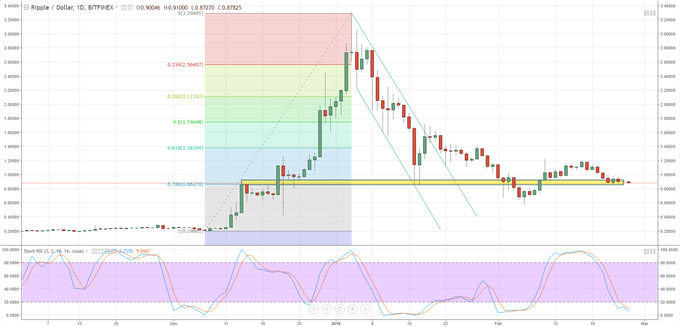

Ripple (XRP) Likely to Fall Through Support.

Ripple (XRP) continues its week-long battle with support between $0.85 and $0.93 and may also be forming a head and shoulders pattern with the bottom of left shoulder made on February 9 around $0.74. A break below there would open up the downside to the February 6 low of around $0.575. If support holds, the digital token may re-test the $1.20 - $1.23 area made up of the February 10 and 18 high prints.

Ripple Price Chart Daily Time Frame (November 2, 2017 – February 26, 2018)

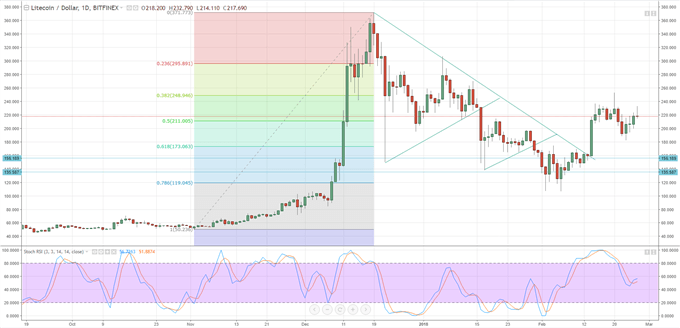

Litecoin’s (LTC) Higher Lows May See Prices Push Further Ahead

A series of four higher lows in a row has underpinned Litecoin in the last week despite the overall market weakness. LTC currently trades around $219, just above the 50% Fibonacci support at $211 and sharply higher than the recent February 23 low at $182 which should provide decent support in the case of any sell-off. The first upside target remains at $248.

Litecoin Price Chart Daily Time Frame (September 19, 2017 – February 26, 2018)

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash or Ethereum we can offer you a wide range of free resources to help you. We have an Introduction to Bitcoin Trading Guide. In addition we have an IG Bitcoin Sentiment Indicator to help you gauge the market and make more informed trading decisions.

We cover a range of cryptocurrency charts and set-ups at our Weekly Cryptocurrency Webinar on Wednesdays at 12:00 GMT.

What’s your opinion on the cryptocurrency market at the moment? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1.

--- Written by Nick Cawley, Analyst.