To get the Asia AM Digest every day, SIGN UP HERE

The Canadian Dollar was the best performing major on Friday thanks to a better-than-expected local CPI report. Headline inflation was anticipated to slow down to 1.5% year-over-year (YoY) in January from 1.9% in December. In reality, CPI only ticked down to +1.7%.

In addition, there was a positive surprise in Bank of Canada’s preferred measure of inflation. The “common” component of core CPI, which is not affected by sector-specific price movements, rose to 1.8% (YoY) versus 1.7% estimated and from 1.6% prior. That was the fastest pace of price gains since April 2012.

The data appeared to increase near-term Bank of Canada rate hike expectations. Indeed, local 2-year government bond yields rallied alongside the release. However, when the central bank raised rates in January, it offered a cautionary outlook on inflation that lowered expectations of a more aggressive path of easing. We will see what they have to say about prices at their March 7th rate decision.

Elsewhere, the sentiment-linked New Zealand Dollar was one of the worst performing majors despite a rosy day for stocks. Both the Nikkei 225 and S&P 500 ended the day 0.72% and 1.60% higher respectfully. Meanwhile, the anti-risk Swiss Franc underperformed as well.

The Kiwi Dollar’s weakness may have been due to gains seen in the US Dollar earlier in the day. As we mentioned before, the reality that the New Zealand Dollar may soon lose its yield advantage to the greenback saps its appeal.

The Fed’s release of February’s monetary policy report to congress boosted Wall Street, depressed local bond yields and the US Dollar later in the day. Policymakers noted that the pace of wage gains are moderate and that they are held down by low productivity.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

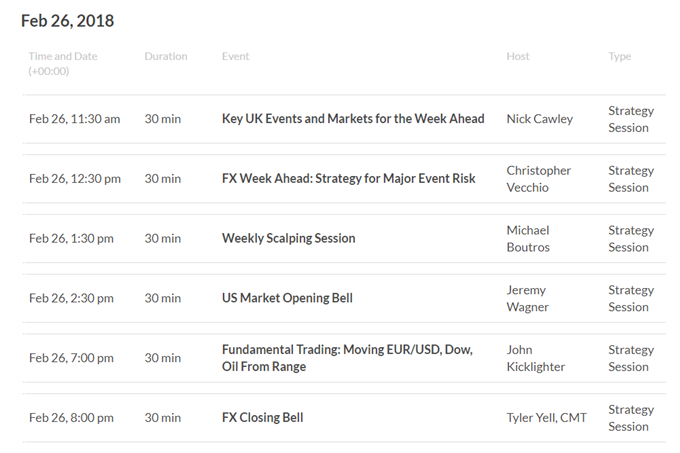

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

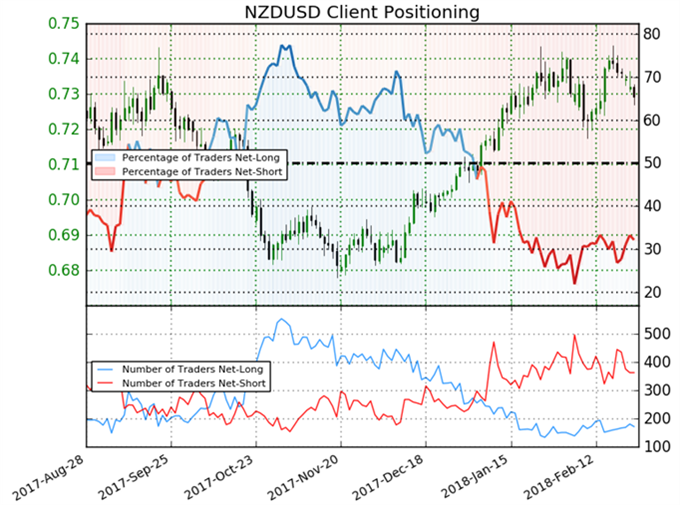

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 32.1% of NZD/USD traders are net-long with the ratio of traders short to long at 2.11 to 1. In fact, traders have remained net-short since Jan 05 when NZD/USD traded near 0.70915; price has moved 2.9% higher since then. The number of traders net-long is 1.2% higher than yesterday and 12.4% higher from last week, while the number of traders net-short is 5.7% lower than yesterday and 4.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading:

- EUR/USD Weekly Technical Forecast: Euro Set to Turn Back to the Upside? by Paul Robinson, Market Analyst

- What’s Next for Blockchain Technology? by the DailyFX Research Team

- Dollar Faces Monetary Policy, Protectionism and Euro’s Cross Winds by John Kicklighter, Chief Currency Strategist

- Australian Dollar Likely Pulled One Way By US, Another By China by David Cottle, Analyst

- US Dollar May Fall Further on Timid FOMC Meeting Minutes by Daniel Dubrovsky, Jr. Currency Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here