To get the Asia AM Digest every day, SIGN UP HERE

The US Dollar appreciated against its major counterparts for a fourth day, continuing inversely following Wall Street. You did not have to look far to find that the Fed’s minutes from the January meeting contributed to this towards the end of the trading session. In the report, there were references to heightened growth expectations that as a result, raises the likelihood of further gradual policy firming.

Such a scenario is not supportive for stocks, the S&P 500 and Dow Jones dived in the aftermath of the FOMC minutes. They ended the day 0.6% and 0.7% lower respectfully. Sentiment-linked currencies such as the Australian Dollar suffered as well.

Meanwhile, the British Pound was volatile as expected, swinging between losses and gains throughout the session. First, hindered by a soft employment report. Then, boosted by hawkish remarks from the Bank of England. Governor Mark Carney and Chief Economist Andy Haldane both talked about rising wage pressures.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

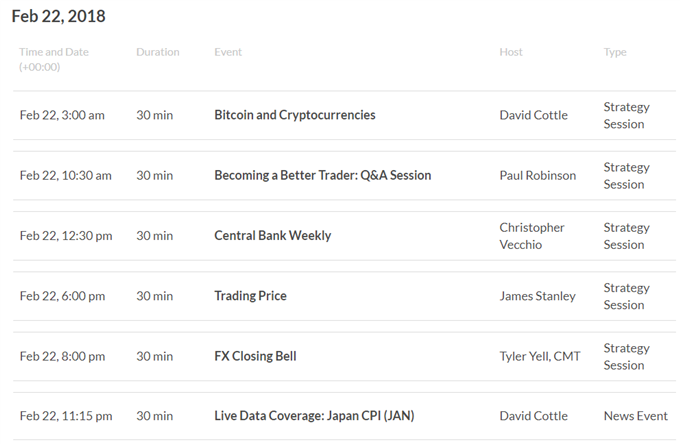

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

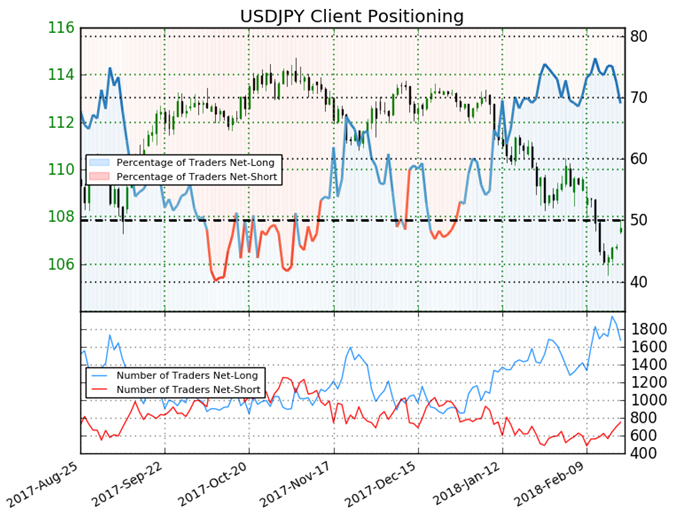

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 69.1% of USD/JPY traders are net-long with the ratio of traders long to short at 2.23 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 113.244; price has moved 5.1% lower since then. The number of traders net-long is 14.6% lower than yesterday and 6.3% higher from last week, while the number of traders net-short is 18.6% higher than yesterday and 29.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- FX Overbought/Oversold Report: Finding Opportunities in Extremes by Tyler Cell, CMT, Forex Trading Instructor

- USD/CHF Rallies to Resistance: Will Sellers Respond? by James Stanley, Currency Strategist

- FOMC Minutes Further Rate Speculation but Not the Dollar’s Gains by John Kicklighter, Chief Currency Strategist, and the DailyFX Research Team

- AUD/NZD Price Tumbles to Five-Month Lows; Relief in Sight? by Michael Boutros, Currency Strategist

- Gold Prices Remain Vulnerable After Failing to Test 2018-High by David Song, Currency Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here