To get the Asia AM Digest every day, SIGN UP HERE

The US Dollar got no love on Valentine’s Day and ended up the worst performing major on Wednesday. Interestingly, the greenback was on its way higher as a better-than-expected CPI report crossed the wires. Local 2-year government bond yields even rallied. However, everything went downhill from there.

Shortly after the data release, Wall Street opened for trading and the S&P 500 gapped lower. Almost immediately, the index climbed and the US Dollar declined. The S&P 500 finished the day 1.34% higher along with the Dow Jones. Puzzlingly, front-end bond yields remained elevated.

This kind of trading environment is similar to what we have seen in 2017 when the US Dollar was unable to capitalize on firming Fed rate hike bets. In addition, January’s NFPs set a high bar for inflation expectations and the markets might have been underwhelmed today. While US CPI did beat estimates, the data fell mostly in line with the previous period and seems unlikely to change the pace of Fed tightening.

With that in mind, the sentiment-sensitive New Zealand Dollar scored gains against its major counterparts as Wall Street pushed higher. The anti-risk Swiss Franc on the other hand lost some ground.

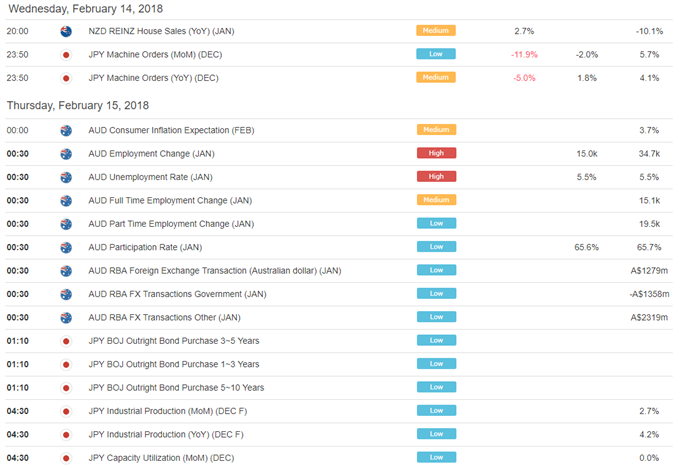

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

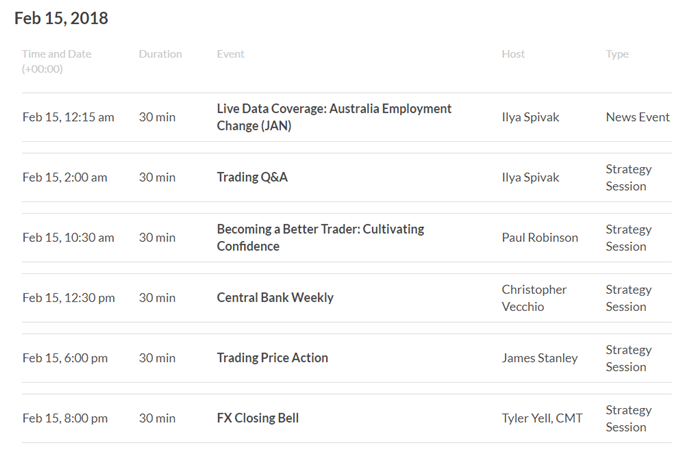

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

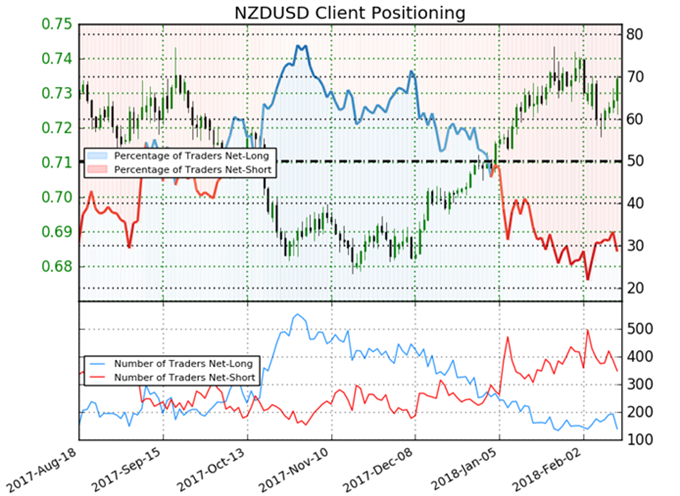

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 28.6% of NZD/USD traders are net-long with the ratio of traders short to long at 2.49 to 1. In fact, traders have remained net-short since Jan 05 when NZD/USD traded near 0.70925; price has moved 3.5% higher since then. The number of traders net-long is 25.5% lower than yesterday and 34.9% lower from last week, while the number of traders net-short is 11.6% lower than yesterday and 22.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

Five Things Traders are Reading:

- AUD/USD Options-Derived Volatility Gains Ahead of Jobs Data by Daniel Dubrovsky, Jr. Currency Analyst

- Upbeat Australia Employment Report to Bolster AUD/USD Recovery by David Song, Currency Analyst

- South African Rand at Two-Year Highs as End of Zuma Era Nears by Martin Essex, MSTA, Analyst and Editor

- Litecoin Prices Rip Into Resistance Ahead of Hard Fork by Michael Boutros, Currency Strategist

- Bitcoin Price Surges 57% off Monthly Lows- Bullish Breakout Potential by Michael Boutros, Currency Strategist

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here