Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The US Dollar is down for the second consecutive day, shedding its temporary ‘safe haven’ status as both equities and bond yields move lower on Tuesday. Market participants have proven skeptical over the current trading environment, with measures of equity volatility remaining high relative to their 20-day moving averages (VIX was at 27.14 at the time this report; the 20-day average was 18.74). Measures of FX volatility have started to perk up as well. Elsewhere, the British Pound received a boost after the January CPI report showed price pressures remain firm, giving credibility to some BOE policymakers’ recent claims that a rate hike may need to come sooner than currently anticipated (rates markets pricing in August 2018 for next hike).

DailyFX Economic Calendar: Tuesday, February 13, 2018 – North American Releases

Another quiet day on the North American economic calendar means the news wire will be in focus again on Tuesday. The early-week lull in economic data from Canada and North America won’t last long, as the January US CPI and Retail Sales reports due tomorrow should prove incendiary for USD-pairs. Join Senior Currency Strategist Christopher Vecchio, CFA at 8:15 EST/13:15 GMT tomorrow for live coverage of the data.

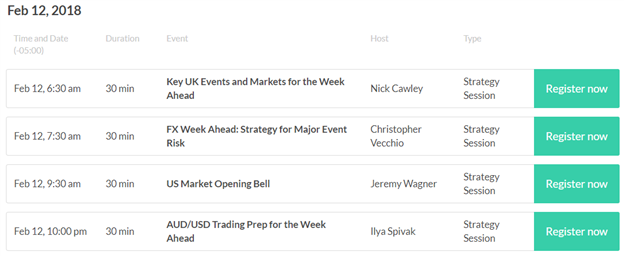

DailyFX Webinar Calendar: Tuesday, February 13, 2018

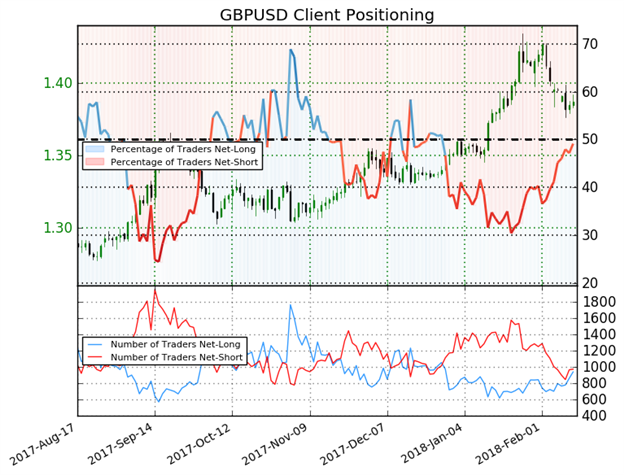

IG Client Sentiment Index Chart of the Day: GBPUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

GBPUSD: Retail trader data shows 49.1% of traders are net-long with the ratio of traders short to long at 1.04 to 1. The number of traders net-long is 14.5% higher than yesterday and 16.7% higher from last week, while the number of traders net-short is 2.7% higher than yesterday and 11.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “US Dollar Bounces, but Hasn’t Bottomed Yet - Key Levels” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Technical Outlook for S&P 500, DAX, US & UK Crude Oil, Gold & More” by Paul Robinson, Market Analyst

- “UK Bond Yields will Underpin GBP in the Weeks Ahead” by Nick Cawley, Analyst

- “GBPUSD Firms as UK Inflation Tops Expectations” by Martin Essex, MSTA, Analyst and Editor

- “FTSE Technical Outlook: Bouncing from Support, but Can It Last?” by Paul Robinson, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.