To get the Asia AM Digest every day, SIGN UP HERE

The anti-risk Japanese Yen and Swiss Franc outperformed on Thursday as Wall Street’s selloff this week continued amidst fears of higher inflation. Indeed, today’s 30-year US government bond auction saw demand fall as yields rose to the highest since March’s sale.

Meeting the criteria for a correction, the S&P 500 fell 3.8 percent bringing the total decline from the January 26th high to over 10 percent. Meanwhile, sentiment-sensitive currencies such as the Australian and New Zealand Dollars suffered.

In England, the BoE’s “Super Thursday” helped push the British Pound higher against its major counterparts. The central bank took a hawkish stance and Governor Mark Carney hinted at an early interest rate rise.

Looking ahead, the US Senate is poised to approve a bipartisan budget deal. The temporary spending bill that was passed in late-January funded the federal government through February 8th.

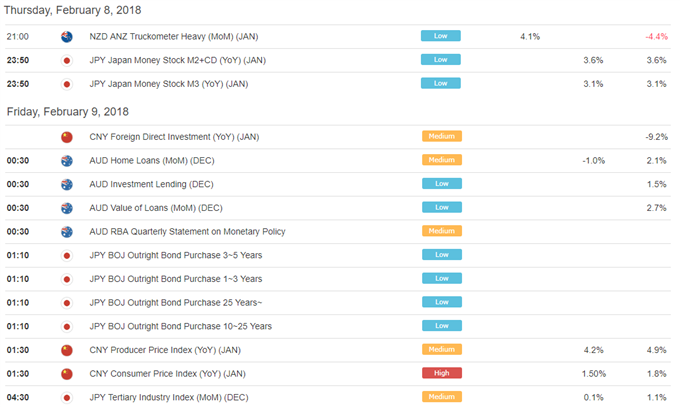

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

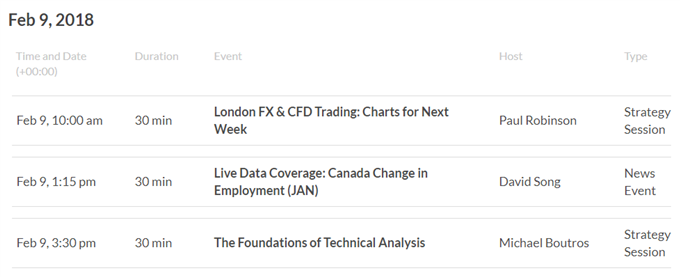

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

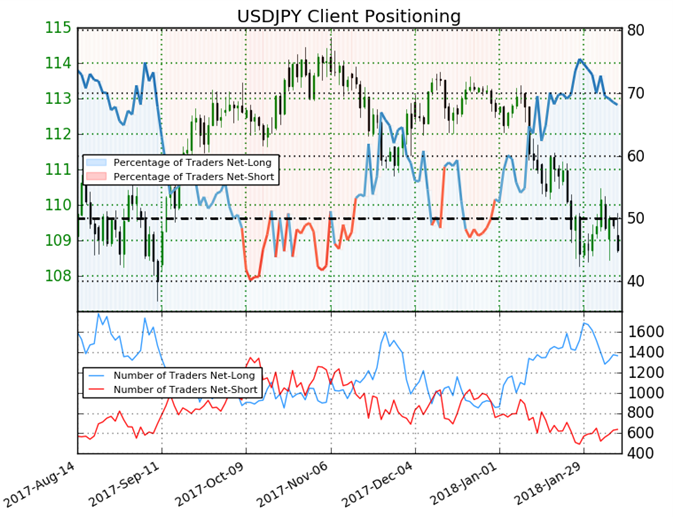

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 68.1% of USD/JPY traders are net-long with the ratio of traders long to short at 2.14 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 113.317; price has moved 4.1% lower since then. The number of traders net-long is 6.5% lower than yesterday and 13.1% lower from last week, while the number of traders net-short is 0.2% lower than yesterday and 10.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- NZD/USD Technical Analysis: Deeper Downturn Seen Ahead by Ilya Spivak, Sr. Currency Strategist

- EUR/USD Elliott Wave Analysis: 3 Ending Waves Meet a 10 Year Trend Line by Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

- Crude Oil Price Forecast: How Bullish Institutions Became a Liability by Tyler Yell, CMT, Forex Trading Instructor

- As the US Dollar Gains, Stocks Feel the Pain by James Stanley, Currency Strategist

- GBPUSD Surges on Hawkish Bank of England by Martin Essex, MSTA, Analyst and Editor

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here