To get the Asia AM Digest every day, SIGN UP HERE

The New Zealand Dollar edged higher against its major counterparts following an impressive jobs report. Prior to the data, the sentiment-linked currency was already recovering as the markets took a breather following yesterday’s panic selloff.

Likewise, other sentiment-sensitive currencies such as the Australian and Canadian Dollars enjoyed a rosy session. The anti-risk Japanese Yen and Swiss Franc on the other hand suffered losses as the S&P 500 pulled back slightly during Tuesday’s session.

Commenting on yesterday’s aggressive risk aversion, St. Louis Fed President James Bullard said that it was “the most predicted market selloff of all time”. With policymakers appearing to see it as not much of a surprise, Bullard noted that he does not see policy changing appreciably.

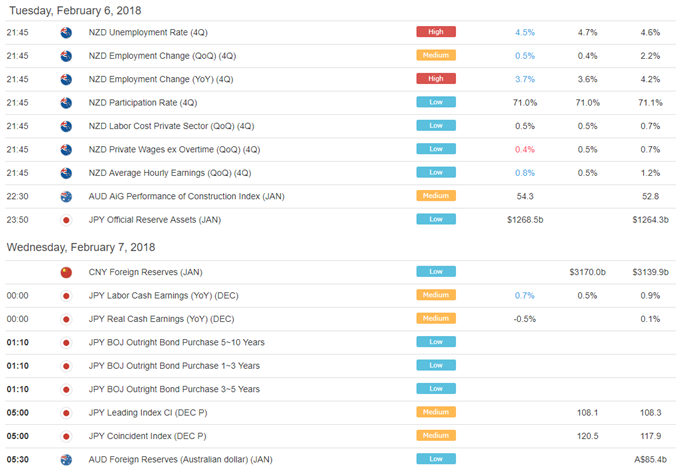

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

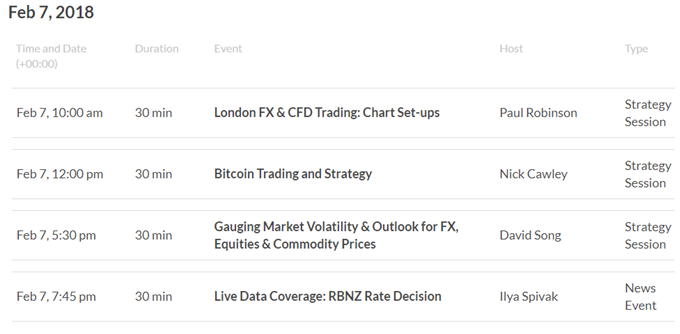

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

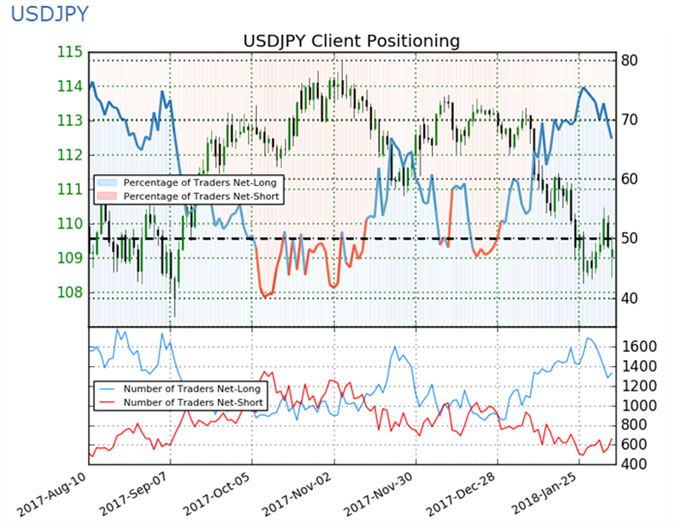

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 66.8% of USD/JPY traders are net-long with the ratio of traders long to short at 2.01 to 1. In fact, traders have remained net-long since Dec 29 when USD/JPY traded near 113.317; price has moved 3.6% lower since then. The number of traders net-long is 7.6% lower than yesterday and 21.8% lower from last week, while the number of traders net-short is 3.9% higher than yesterday and 4.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- New Zealand Dollar Reverses Monday Panic on Striking Jobs Report by Daniel Dubrovsky, Jr. Currency Analyst

- EUR/GBP Technical Analysis: Euro Uptrend Set to Accelerate? by Ilya Spivak, Sr. Currency Strategist

- EUR/USD, GBP/USD Pull Backs in Question After USD Breakout Falters by James Stanley, CurrencyStrategist

- Elliott Wave Analysis: Dow Jones, Nasdaq, and Dax 30 Dive Impulsively by Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

- Gold Price Hit by US Dollar Strength by Nick Cawley, Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here